Thursday, December 8, 2011

Wednesday, December 7, 2011

Jon Corzine and MF Global

Questions to ask Jon Corzine at the hearings this morning (if he doesn't take the fifth):

http://dealbook.nytimes.com/2011/12/07/10-questions-for-jon-corzine/?hp

http://dealbook.nytimes.com/2011/12/07/10-questions-for-jon-corzine/?hp

Tuesday, December 6, 2011

Monday, December 5, 2011

Goldman Sachs and Greece Responsibility

Last spring: U.S. and European officials are looking into how U.S. investment bank Goldman Sachs Group Inc. may have helped Greece disguise the size of its budget deficit through the use of cross-currency derivatives in 2001.

Labels:

goldman sachs.

Wednesday, November 23, 2011

Dov and David

Dov Seidman on Charlie Rose on Bloomberb in Manila 10:00 pm November 23, 2011. His book "How."

First 1/2 was with David Brooks. Awesome.

First 1/2 was with David Brooks. Awesome.

Labels:

David Brooks,

dov seidman

Friday, November 18, 2011

Thursday, November 10, 2011

You Want a Job, Don't You?

"You want a job, don't you?"

"It's all word-association and where you come from, Mr. Cain. You're from Happy Valley; I HAVE a Happy Valley. You say poTAto, I say Palo Alto; you say toMAtoe, I say toMAHto.You say Paterno, I say Patino; your team is Seduce-U I think Sandusky; you say McQuery, I say Ceder Point. Let's talk about overtime. Or we'll cross that Tressel when we come to it."

"It's all word-association and where you come from, Mr. Cain. You're from Happy Valley; I HAVE a Happy Valley. You say poTAto, I say Palo Alto; you say toMAtoe, I say toMAHto.You say Paterno, I say Patino; your team is Seduce-U I think Sandusky; you say McQuery, I say Ceder Point. Let's talk about overtime. Or we'll cross that Tressel when we come to it."

Labels:

humor

Wednesday, November 9, 2011

Replacing Lost Passport and Birthdays of Parents

Catherine Hill Abel

March 14, 1910

Frederick Abel

February 25, 1906

March 14, 1910

Frederick Abel

February 25, 1906

What Happened?

If you're wondering what happened to the Cursing Mommy column scheduled for today, please don't worry--"How to Make a Festive Holiday Centerpiece Out of Used Coffee Filters and Then Throw It at Your Fucking Husband's Head" will definitely appear next week.

Labels:

ian frazier

Strictly Local

I had a hard time trying to figure when the Princeton High School levies would fully-hit our tax bills. Google was no help. Nor was a call to the Board of Education earlier in the week. I finally went to the Board of Education and while I was waiting for someone from the treasurer's office to come out I flipped through a scrapbook of articles on Princeton, mainly sports. I came across the following, copied it in my own handwriting and told the receptionist that I didn't need to speak to anyone else. My notes:

On Election Day

From February 19, 2010 Enquirer

$120 million, 37-yr bond issue @ 3.52 mills would pay for a new high school and middle school. A related 1.45 mill permanent improvement levy would pay for capital improvements. The owner of a $100,000 home would pay an additional $44.40 a year beginning in January, 2011. [$300,000 = $133.20]

When the levy begins, and beginning in 2013, that would grow to $149.28 for a $100,000 home [$447.84 for a $300,000 home]

LikeUnlike · · 13 hours ago · Write a comment.....

.

On Election Day

From February 19, 2010 Enquirer

$120 million, 37-yr bond issue @ 3.52 mills would pay for a new high school and middle school. A related 1.45 mill permanent improvement levy would pay for capital improvements. The owner of a $100,000 home would pay an additional $44.40 a year beginning in January, 2011. [$300,000 = $133.20]

When the levy begins, and beginning in 2013, that would grow to $149.28 for a $100,000 home [$447.84 for a $300,000 home]

LikeUnlike · · 13 hours ago · Write a comment.....

.

Labels:

strictly local

Tuesday, November 8, 2011

Friday, October 21, 2011

Aggregation for Glendale -- Don't Sign Up; Get Out; Opt Out!

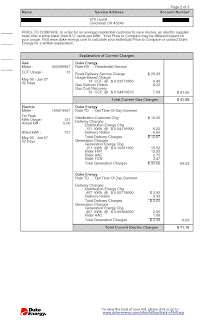

Send to babel2@fuse.net or 970 Laurel Avenue, Cincinnati, OH 45246; also send your confidential ID and Password to get into Duke's website.

Bring a copy of your last Duke Energy bill or email it to me for an analysis of the natural gas situation and Glendale’s aggregation price. Even better, go online at Duke and, after giving your password, etc., click on “energy usage & cost details” and run the top 12 months on excel to come up with cost per ccf for the last 12 months,” and bring that.

Bring a copy of your last Duke Energy bill or email it to me for an analysis of the natural gas situation and Glendale’s aggregation price. Even better, go online at Duke and, after giving your password, etc., click on “energy usage & cost details” and run the top 12 months on excel to come up with cost per ccf for the last 12 months,” and bring that.

Labels:

aggregation,

Heating Degree Days,

natural gas

Aggregation for Glendale -- Don't Sign Up; Get Out; Opt Out!

Labels:

aggregation

Sunday, October 16, 2011

Natural Gas Aggregation

Glendale Natural Gas Aggregation Exposed

This inquiry came from a friend in Glendale in response to the Village Notice of Friday:

My answer, some of which I also put on Facebook:

There is a lot of "puffing" and misleading going on in this realm so it's not easy to analyze. Towns, not having the in-house expertise, put out the wording (such as below) prepared by the natural gas broker and the misleading is rampant and outrageous. This is a good example of local government gone wild, gambling with the citizen’s money without even knowing it! (Note: The electric aggregation so far worked very well, as I recommended a year ago doing it when I saw that Duke was pretty likely not to lower their electric rates.)

And the consequences can be huge as natural gas can be volatile when business is booming. The swings can be in the thousands of dollars for a big old residential home in Glendale over a given year when one looks back.

Upper Arlington and others in Columbus locked into a “good deal” with Columbia Gas and citizens took a huge hit over the next couple of years when natural gas plunged, as it will do this coming year. Check out “Gearino…Columbia Gas…Columbus Dispatch” on Google. http://www.citizensutilityboard.org/pdfs/CUBInTheNews/20090503_CD_ARGS.pdf

• Usually what to do is a guess and the information given to us by the Glendale email isn't worth a crap as I will begin to demonstrate.

• We are less than 15 days from the beginning of the winter heating season and there is little time to get answers! Why such poor planning? Get off the natural gas aggregation if you are now on it. Go back to Duke and clear the air before committing to a competitor again. At least until we can get an impartial analysis.

[I’m going to set up a presentation at the Lyceum Wednesday morning at 10 am (if Cindy gives the go-ahead) and people should bring their last Duke utility bill and a copy for me to work with. And I’ll try to have Don Marshall be there as well. And somebody from Duke and somebody from Duke Retail. Anybody from the Village administration would be welcome but essentially worthless. Having said this we did save some money – not what the blurb this summer stated -- on the electric aggregation which I analyzed a year ago with a jaundiced eye and recommended people go for it. Not so with natural gas, and my prediction proved correct, as implied by the village notice below.]

Some off the top (my commentary) on the Village’s email announcement which appears below my commentary:

• "Beginning January 2012." What does that mean? January USAGE? January's BILL, which would include December's usage? In either case it includes only part of this winter and mainly locks us into rates for next winter, which is way too far into the future.

• What is missing is what Duke's MOST RECENT MONTHLY RATE is and what Duke projects for the next five months. What is given is an irrelevant "price in effect for this year."

• The only "good deal" would be if the negotiated rate is "10% below whatever the Duke rate is each month starting NOW," then it's a good deal.

• Duke's rate will go down more than 10% as the year goes on, and is already below “$6.10.” (Reminder: “$6.10” is only a shorthand for a certain part of the bill. Do the following before you come to the meeting: divide your total natural gas dollars by total ccf, for the last 12 months. You’ll find that you’ve been paying more than $6.10 for every month; so the “good deal” $5.58 is equally shorthand.)

• If you opted out of Glendale’s natural gas aggregation a year ago as I did, I would opt out again, as you suggest.

• If you opted in, you should now go back to Duke Energy, pending further inquiry.

• Remember, the only months of note are usage for November, December, January, February and March.

> The following is from the village on Friday, circulated by email. It

> -----Original Message-----

> From: Glendale

This inquiry came from a friend in Glendale in response to the Village Notice of Friday:

>Bruce - Goodness, I really hate to bother you w/ this, but I can't make head

> nor tail of our bills.

> Are we on this, do you remember? Do I need to get on it if we're not?

> Think I'd decided to just pay & not worry about it, since you spent a whole

> day on this last year & didn't find anything wrong. Thank you again for

> that...

My answer, some of which I also put on Facebook:

There is a lot of "puffing" and misleading going on in this realm so it's not easy to analyze. Towns, not having the in-house expertise, put out the wording (such as below) prepared by the natural gas broker and the misleading is rampant and outrageous. This is a good example of local government gone wild, gambling with the citizen’s money without even knowing it! (Note: The electric aggregation so far worked very well, as I recommended a year ago doing it when I saw that Duke was pretty likely not to lower their electric rates.)

And the consequences can be huge as natural gas can be volatile when business is booming. The swings can be in the thousands of dollars for a big old residential home in Glendale over a given year when one looks back.

Upper Arlington and others in Columbus locked into a “good deal” with Columbia Gas and citizens took a huge hit over the next couple of years when natural gas plunged, as it will do this coming year. Check out “Gearino…Columbia Gas…Columbus Dispatch” on Google. http://www.citizensutilityboard.org/pdfs/CUBInTheNews/20090503_CD_ARGS.pdf

• Usually what to do is a guess and the information given to us by the Glendale email isn't worth a crap as I will begin to demonstrate.

• We are less than 15 days from the beginning of the winter heating season and there is little time to get answers! Why such poor planning? Get off the natural gas aggregation if you are now on it. Go back to Duke and clear the air before committing to a competitor again. At least until we can get an impartial analysis.

[I’m going to set up a presentation at the Lyceum Wednesday morning at 10 am (if Cindy gives the go-ahead) and people should bring their last Duke utility bill and a copy for me to work with. And I’ll try to have Don Marshall be there as well. And somebody from Duke and somebody from Duke Retail. Anybody from the Village administration would be welcome but essentially worthless. Having said this we did save some money – not what the blurb this summer stated -- on the electric aggregation which I analyzed a year ago with a jaundiced eye and recommended people go for it. Not so with natural gas, and my prediction proved correct, as implied by the village notice below.]

Some off the top (my commentary) on the Village’s email announcement which appears below my commentary:

• "Beginning January 2012." What does that mean? January USAGE? January's BILL, which would include December's usage? In either case it includes only part of this winter and mainly locks us into rates for next winter, which is way too far into the future.

• What is missing is what Duke's MOST RECENT MONTHLY RATE is and what Duke projects for the next five months. What is given is an irrelevant "price in effect for this year."

• The only "good deal" would be if the negotiated rate is "10% below whatever the Duke rate is each month starting NOW," then it's a good deal.

• Duke's rate will go down more than 10% as the year goes on, and is already below “$6.10.” (Reminder: “$6.10” is only a shorthand for a certain part of the bill. Do the following before you come to the meeting: divide your total natural gas dollars by total ccf, for the last 12 months. You’ll find that you’ve been paying more than $6.10 for every month; so the “good deal” $5.58 is equally shorthand.)

• If you opted out of Glendale’s natural gas aggregation a year ago as I did, I would opt out again, as you suggest.

• If you opted in, you should now go back to Duke Energy, pending further inquiry.

• Remember, the only months of note are usage for November, December, January, February and March.

> The following is from the village on Friday, circulated by email. It

> -----Original Message-----

> From: Glendale

>

Sent: Friday, October 14, 2011 7:14 PM

> To: Glendale Subscriber

> Subject: VILLAGE COUNCIL NEGOTIATES LOWER GAS PRICES

>

> VILLAGE COUNCIL NEGOTIATES LOWER GAS PRICES

>

> The Village Council has negotiated a lower rate for natural gas applicable

> to the Village natural gas aggregation program. Beginning January 2012, the

> aggregation rate for Village residents will be lower by ten percent compared

> to the price that was in effect during this year. The rate for 2011 has

> been $6.18 per 1000 cubic feet and will decrease to $5.58 for next year.

> That means that residents will realize about a $12 per month savings during

> the up-coming winter heating months from what they paid this year. And while

> annual savings have not been as great as originally projected, http://www.wtrg.com/daily/ngspot.gif

Labels:

aggregation,

dan gearino,

natural gas

Thursday, September 29, 2011

Saturday, September 24, 2011

Mohamed A. El-Erian

This guy works for Bill Gross, the best bond market guru and manager. Mohamed is brilliant and is interviewed on CNBC when important crises are afoot.

They don’t have six weeks,” said Mohamed A. El-Erian, chief executive of Pimco, the world’s largest bond manager. He said fear had reached the very core of the 17-nation group that uses the euro currency, with the price of insurance on German debt rising substantially this week.

“The light already is flashing yellow,” Mr. El-Erian said. “They can’t allow it to flash red. You have to give people a vision of what you want the euro zone to look like.”

They don’t have six weeks,” said Mohamed A. El-Erian, chief executive of Pimco, the world’s largest bond manager. He said fear had reached the very core of the 17-nation group that uses the euro currency, with the price of insurance on German debt rising substantially this week.

“The light already is flashing yellow,” Mr. El-Erian said. “They can’t allow it to flash red. You have to give people a vision of what you want the euro zone to look like.”

Saturday, September 17, 2011

Monday, August 29, 2011

Ten Things

The deeper meaning to my purchase of 1000 BAC the morning Warren Buffet announced his purchase: it was a day of otherwise huge import in our family, as Doug and Becca and kids were moving to Barcelona. For me to make such a purchase just before taking them to the airport was "a signature moment." We'll see if it works out.

Friday, August 26, 2011

Ten Things

Warren Buffet stepped up to the plate on Cramer's Item No. 2 yesterday. I "bit" for 1000 BAC at near the high of the day and I'm proud of it, although I sold 500 near the low of the day. Jim defended the bullishness of BAC in his opening segment last night, bashing the short-sellers who dumped on the Buffet deal (from the point of view of BAC). Mainly the Fast Money crowd.

Wednesday, August 24, 2011

Ten Things

OK, so we had this tremendously up day yesterday and some of Cramer's "Ten Things" started to turn around. This raises the age-old problem. Since they all have not turned, is this an opportunity to sell????

Review of Ten Things

1. leaders coming back from vacation; ????

2. banks stopping going down; yes except for BAC, which is Blodget's and everybody else's short sale as a proxy for european banks which cannot be shorted anymore.

3. tech's seasonal slump has to end. On examination of this one it appears the calendar is the only determinant, as this happens in the last week of September.

must be more mergers and acquisitions;

4. must be more mergers and acquisitions; not that I heard about yesterday, but I was laser-tagging with Owen and his friends yesterday.

5. must be lower stock and gold prices; yes as to the latter only. So Cramer is saying "Sell this rally."

6. Europe must step up its game; certainly rumblings out of German principals on this one.

7. Brent crude must go below 100; no help yesterday.

8. China must stop raising rates; don't know. How find out?

9. Europe says we'll stick with a VERSION of the euro, not the euro; stay tuned, not yet.

10. must be some stock leadership. where was the leadership yesterday? techs and most banks probably.

Review of Ten Things

1. leaders coming back from vacation; ????

2. banks stopping going down; yes except for BAC, which is Blodget's and everybody else's short sale as a proxy for european banks which cannot be shorted anymore.

3. tech's seasonal slump has to end. On examination of this one it appears the calendar is the only determinant, as this happens in the last week of September.

must be more mergers and acquisitions;

4. must be more mergers and acquisitions; not that I heard about yesterday, but I was laser-tagging with Owen and his friends yesterday.

5. must be lower stock and gold prices; yes as to the latter only. So Cramer is saying "Sell this rally."

6. Europe must step up its game; certainly rumblings out of German principals on this one.

7. Brent crude must go below 100; no help yesterday.

8. China must stop raising rates; don't know. How find out?

9. Europe says we'll stick with a VERSION of the euro, not the euro; stay tuned, not yet.

10. must be some stock leadership. where was the leadership yesterday? techs and most banks probably.

Tuesday, August 23, 2011

Ten Things

Cramer has done this before and it is good as a trading guide. Last night he listed ten things or concepts that had to happen that would make the market good to invest in again. It is not yet posted, so I will now go down into the barn room and look at it on TIVO and then replicate it here.

When he did this before he didn't wait until all of his list was satisfied before he became bullish again, as I recall.

Based on the ten things we have a ways to wait.

Being old, I can remember only one -- gold going down three straight days. (It is down this morning in pre- trading.)

OK, here are the 10:

1. leaders have to come back from vacation;

2. bank stocks have to stop going down;

3. tech's seasonal slump has to end;

4. must be more mergers and acquisitions;

5. must be lower stock and gold prices;

6. Europe must step up its game;

7. Brent crude must go below 100;

8. China must stop raising rates;

9. Europe says we'll stick with a VERSION of the euro, not the euro;

10. must be some stock leadership.

Wow! is gold going down or what? dn 2.91 as I type (GLD, that is, which is 1/10th of real gold).

When he did this before he didn't wait until all of his list was satisfied before he became bullish again, as I recall.

Based on the ten things we have a ways to wait.

Being old, I can remember only one -- gold going down three straight days. (It is down this morning in pre- trading.)

OK, here are the 10:

1. leaders have to come back from vacation;

2. bank stocks have to stop going down;

3. tech's seasonal slump has to end;

4. must be more mergers and acquisitions;

5. must be lower stock and gold prices;

6. Europe must step up its game;

7. Brent crude must go below 100;

8. China must stop raising rates;

9. Europe says we'll stick with a VERSION of the euro, not the euro;

10. must be some stock leadership.

Wow! is gold going down or what? dn 2.91 as I type (GLD, that is, which is 1/10th of real gold).

Labels:

cramer last night

Sunday, August 21, 2011

Monday, August 15, 2011

Wednesday, August 10, 2011

Cramer Last Night

His shopping list last night:

So what's on our diversified dividend shopping list, after we've had this incredible crack in the stock market?...

Cramer's Diversified Dividend Play #1:

Consolidated Edison, Inc.

Dividend Yield: 4.7%

Cramer's Diversified Dividend Play #2:

Enterprise Products Partners LLC

Dividend Yield: 6%

Cramer's Diversified Dividend Play #3:

Verizon Communications, Inc.

Dividend Yield: 5.8%

Cramer's Diversified Dividend Play #4:

Bristol-Myers Squibb Co.

Dividend Yield: 4.9%

Cramer's Diversified Dividend Play #5:

Darden Restaurants, Inc.

Dividend Yield: 3.7%

Cramer's Diversified Dividend Play #6:

Kimberly-Clark Corporation

Dividend Yield: 4.4%

Cramer's Diversified Dividend Play #7:

International Paper Company

Dividend Yield: 4.4%

Labels:

checklist,

Cramer and October 8,

cramer last night,

crash now

Tuesday, August 9, 2011

Very Important

The following is a repeat citation of a very, very important piece presented to Congress last year. Deals with Countrywide and, more important, the nuts and bolts of the mrtgage crisis.

http://financialservices.house.gov/Media/file/hearings/111/Levitin111810.pdf

http://financialservices.house.gov/Media/file/hearings/111/Levitin111810.pdf

Sunday, August 7, 2011

Scoring for Card Game of 500

http://www.pagat.com/euchre/500.html

Scoring

A cumulative score is kept for each team, to which the score for each hand is added or subtracted. The scores for the various contracts are as follows:

Tricks Spades Clubs Diamonds Hearts No Trumps Misere

Six 40 60 80 100 120

Seven 140 160 180 200 220

Misere 250

Eight 240 260 280 300 320

Nine 340 360 380 400 420

Ten 440 460 480

Open Misere 500

Ten 500 520

Scoring

A cumulative score is kept for each team, to which the score for each hand is added or subtracted. The scores for the various contracts are as follows:

Tricks Spades Clubs Diamonds Hearts No Trumps Misere

Six 40 60 80 100 120

Seven 140 160 180 200 220

Misere 250

Eight 240 260 280 300 320

Nine 340 360 380 400 420

Ten 440 460 480

Open Misere 500

Ten 500 520

Labels:

Hot Air

Saturday, August 6, 2011

Friday, August 5, 2011

Monday, July 18, 2011

Friday, July 15, 2011

Thursday, July 14, 2011

Sunday, July 10, 2011

Brooks -- The Unexamined Society

Op-Ed Columnist

The Unexamined Society

By DAVID BROOKS

Published: July 7, 2011

http://www.nytimes.com/2011/07/08/opinion/08brooks.html

Over the past 50 years, we’ve seen a number of gigantic policies produce disappointing results — policies to reduce poverty, homelessness, dropout rates, single-parenting and drug addiction. Many of these policies failed because they were based on an overly simplistic view of human nature. They assumed that people responded in straightforward ways to incentives. Often, they assumed that money could cure behavior problems.

The intellectual, cultural and scientific findings that land on the columnist’s desk nearly every day.

Fortunately, today we are in the middle of a golden age of behavioral research. Thousands of researchers are studying the way actual behavior differs from the way we assume people behave. They are coming up with more accurate theories of who we are, and scores of real-world applications. Here’s one simple example:

When you renew your driver’s license, you have a chance to enroll in an organ donation program. In countries like Germany and the U.S., you have to check a box if you want to opt in. Roughly 14 percent of people do. But behavioral scientists have discovered that how you set the defaults is really important. So in other countries, like Poland or France, you have to check a box if you want to opt out. In these countries, more than 90 percent of people participate.

This is a gigantic behavior difference cued by one tiny and costless change in procedure.

Yet in the middle of this golden age of behavioral research, there is a bill working through Congress that would eliminate the National Science Foundation’s Directorate for Social, Behavioral and Economic Sciences. This is exactly how budgets should not be balanced — by cutting cheap things that produce enormous future benefits.

Let’s say you want to reduce poverty. We have two traditional understandings of poverty. The first presumes people are rational. They are pursuing their goals effectively and don’t need much help in changing their behavior. The second presumes that the poor are afflicted by cultural or psychological dysfunctions that sometimes lead them to behave in shortsighted ways. Neither of these theories has produced much in the way of effective policies.

Eldar Shafir of Princeton and Sendhil Mullainathan of Harvard have recently, with federal help, been exploring a third theory, that scarcity produces its own cognitive traits.

A quick question: What is the starting taxi fare in your city? If you are like most upper-middle-class people, you don’t know. If you are like many struggling people, you do know. Poorer people have to think hard about a million things that affluent people don’t. They have to make complicated trade-offs when buying a carton of milk: If I buy milk, I can’t afford orange juice. They have to decide which utility not to pay.

These questions impose enormous cognitive demands. The brain has limited capacities. If you increase demands on one sort of question, it performs less well on other sorts of questions.

Shafir and Mullainathan gave batteries of tests to Indian sugar farmers. After they sell their harvest, they live in relative prosperity. During this season, the farmers do well on the I.Q. and other tests. But before the harvest, they live amid scarcity and have to think hard about a thousand daily decisions. During these seasons, these same farmers do much worse on the tests. They appear to have lower I.Q.’s. They have more trouble controlling their attention. They are more shortsighted. Scarcity creates its own psychology.

Princeton students don’t usually face extreme financial scarcity, but they do face time scarcity. In one game, they had to answer questions in a series of timed rounds, but they could borrow time from future rounds. When they were scrambling amid time scarcity, they were quick to borrow time, and they were nearly oblivious to the usurious interest rates the game organizers were charging. These brilliant Princeton kids were rushing to the equivalent of payday lenders, to their own long-term detriment.

Shafir and Mullainathan have a book coming out next year, exploring how scarcity — whether of time, money or calories (while dieting) — affects your psychology. They are also studying how poor people’s self-perceptions shape behavior. Many people don’t sign up for the welfare benefits because they are intimidated by the forms. Shafir and Mullainathan asked some people at a Trenton soup kitchen to relive a moment when they felt competent and others to recount a neutral experience. Nearly half of the self-affirming group picked up an available benefits package afterward. Only 16 percent of the neutral group did.

People are complicated. We each have multiple selves, which emerge or don’t depending on context. If we’re going to address problems, we need to understand the contexts and how these tendencies emerge or don’t emerge. We need to design policies around that knowledge. Cutting off financing for this sort of research now is like cutting off navigation financing just as Christopher Columbus hit the shoreline of the New World.

A version of this op-ed appeared in print on July 8, 2011, on page A23 of the New York edition with the headline: The Unexamined Society.

Comment 119:

Thank you David Brooks. In the spirit of this wonderful Op Ed piece, I submit this and hope this works: Read "The Beggar" submitted by Lisa B. Youngclaus for the Yale 50th Reunion Book "1000 Voices" a month ago. This written by her husband Bill Youngclaus III, class of '61, whose career was in advertising, a month before his death in 2006.

A black man tugged at my sleeve,

asking for some change

I was startled to be so close to him, a man

I had rejected many time before, but

from a distance.

I had always shrugged no, implying

that I had no change

Which of course we both knew was a lie.

But this time this close, I could see he

was not so old,

And his smell, while not fresh was clean.

His eyes caught mine while I fumbled

In my own crumpled pocket.

My eyes stuck to his, seeing a time

when he was cared for by another's

caution:

don't do that my love, watch out my

darling.

And he would laugh oh so hard know-

ing he was loved,

Attended to, and he would slap his

mamma's face

In mock discord, waiting for the hug

that would

Surely come. And then, and then...I

don't know.

Something painful probably happened

followed

By worse, and then worse even still,

until he arrived

Here to tread on other's mercy, his only

hope

That I, and others, change their minds.

Recommended by 4 Readers

The Unexamined Society

By DAVID BROOKS

Published: July 7, 2011

http://www.nytimes.com/2011/07/08/opinion/08brooks.html

Over the past 50 years, we’ve seen a number of gigantic policies produce disappointing results — policies to reduce poverty, homelessness, dropout rates, single-parenting and drug addiction. Many of these policies failed because they were based on an overly simplistic view of human nature. They assumed that people responded in straightforward ways to incentives. Often, they assumed that money could cure behavior problems.

The intellectual, cultural and scientific findings that land on the columnist’s desk nearly every day.

Fortunately, today we are in the middle of a golden age of behavioral research. Thousands of researchers are studying the way actual behavior differs from the way we assume people behave. They are coming up with more accurate theories of who we are, and scores of real-world applications. Here’s one simple example:

When you renew your driver’s license, you have a chance to enroll in an organ donation program. In countries like Germany and the U.S., you have to check a box if you want to opt in. Roughly 14 percent of people do. But behavioral scientists have discovered that how you set the defaults is really important. So in other countries, like Poland or France, you have to check a box if you want to opt out. In these countries, more than 90 percent of people participate.

This is a gigantic behavior difference cued by one tiny and costless change in procedure.

Yet in the middle of this golden age of behavioral research, there is a bill working through Congress that would eliminate the National Science Foundation’s Directorate for Social, Behavioral and Economic Sciences. This is exactly how budgets should not be balanced — by cutting cheap things that produce enormous future benefits.

Let’s say you want to reduce poverty. We have two traditional understandings of poverty. The first presumes people are rational. They are pursuing their goals effectively and don’t need much help in changing their behavior. The second presumes that the poor are afflicted by cultural or psychological dysfunctions that sometimes lead them to behave in shortsighted ways. Neither of these theories has produced much in the way of effective policies.

Eldar Shafir of Princeton and Sendhil Mullainathan of Harvard have recently, with federal help, been exploring a third theory, that scarcity produces its own cognitive traits.

A quick question: What is the starting taxi fare in your city? If you are like most upper-middle-class people, you don’t know. If you are like many struggling people, you do know. Poorer people have to think hard about a million things that affluent people don’t. They have to make complicated trade-offs when buying a carton of milk: If I buy milk, I can’t afford orange juice. They have to decide which utility not to pay.

These questions impose enormous cognitive demands. The brain has limited capacities. If you increase demands on one sort of question, it performs less well on other sorts of questions.

Shafir and Mullainathan gave batteries of tests to Indian sugar farmers. After they sell their harvest, they live in relative prosperity. During this season, the farmers do well on the I.Q. and other tests. But before the harvest, they live amid scarcity and have to think hard about a thousand daily decisions. During these seasons, these same farmers do much worse on the tests. They appear to have lower I.Q.’s. They have more trouble controlling their attention. They are more shortsighted. Scarcity creates its own psychology.

Princeton students don’t usually face extreme financial scarcity, but they do face time scarcity. In one game, they had to answer questions in a series of timed rounds, but they could borrow time from future rounds. When they were scrambling amid time scarcity, they were quick to borrow time, and they were nearly oblivious to the usurious interest rates the game organizers were charging. These brilliant Princeton kids were rushing to the equivalent of payday lenders, to their own long-term detriment.

Shafir and Mullainathan have a book coming out next year, exploring how scarcity — whether of time, money or calories (while dieting) — affects your psychology. They are also studying how poor people’s self-perceptions shape behavior. Many people don’t sign up for the welfare benefits because they are intimidated by the forms. Shafir and Mullainathan asked some people at a Trenton soup kitchen to relive a moment when they felt competent and others to recount a neutral experience. Nearly half of the self-affirming group picked up an available benefits package afterward. Only 16 percent of the neutral group did.

People are complicated. We each have multiple selves, which emerge or don’t depending on context. If we’re going to address problems, we need to understand the contexts and how these tendencies emerge or don’t emerge. We need to design policies around that knowledge. Cutting off financing for this sort of research now is like cutting off navigation financing just as Christopher Columbus hit the shoreline of the New World.

A version of this op-ed appeared in print on July 8, 2011, on page A23 of the New York edition with the headline: The Unexamined Society.

Comment 119:

Thank you David Brooks. In the spirit of this wonderful Op Ed piece, I submit this and hope this works: Read "The Beggar" submitted by Lisa B. Youngclaus for the Yale 50th Reunion Book "1000 Voices" a month ago. This written by her husband Bill Youngclaus III, class of '61, whose career was in advertising, a month before his death in 2006.

A black man tugged at my sleeve,

asking for some change

I was startled to be so close to him, a man

I had rejected many time before, but

from a distance.

I had always shrugged no, implying

that I had no change

Which of course we both knew was a lie.

But this time this close, I could see he

was not so old,

And his smell, while not fresh was clean.

His eyes caught mine while I fumbled

In my own crumpled pocket.

My eyes stuck to his, seeing a time

when he was cared for by another's

caution:

don't do that my love, watch out my

darling.

And he would laugh oh so hard know-

ing he was loved,

Attended to, and he would slap his

mamma's face

In mock discord, waiting for the hug

that would

Surely come. And then, and then...I

don't know.

Something painful probably happened

followed

By worse, and then worse even still,

until he arrived

Here to tread on other's mercy, his only

hope

That I, and others, change their minds.

Recommended by 4 Readers

Labels:

Good Writing,

yale

Saturday, July 9, 2011

Dan Kucera and His Waterlawg Blog

A good friend, classmate at college and law school, and one of the funniest writers, Dan Kucera, was at our 50th reunion. I discovered he has a blog http://www.waterlawg.blogspot.com/. It is well written and humorous. I have added it to my short list of worthwhile blogs.

Tuesday, June 28, 2011

Monday, June 27, 2011

Derivatives Cloud the Greece Analysis

So the one question I would ask CNBC, etc.: "Why do credit default swaps even exist now????"

http://www.nytimes.com/2011/06/23/business/global/23swaps.html?scp=1&sq=derivatives%20cloud&st=cse

http://www.nytimes.com/2011/06/23/business/global/23swaps.html?scp=1&sq=derivatives%20cloud&st=cse

Saturday, June 25, 2011

Sunday, June 19, 2011

Smart Metering and Poles

Sometime during the week a subcontractor for Duke Energy knocked on the door wanting to clear brush from a pole so that they could put up a piece of electrical equipment that would enable Duke to read my time-of-day meter wirelessly.

Labels:

Duke Energy,

smart metering

Jimmy Rogers Interviewed by Dylan Ratigan!

http://jimrogers-investments.blogspot.com/2011/06/video-greece-is-bankrupt-protect.html

[from Wikipedia] Rogers was born in Baltimore, Maryland and raised in Demopolis, Alabama.[1][3] He started in business at the age of five by selling peanuts and by picking up empty bottles that fans left behind at baseball games. He got his first job on Wall Street, at Dominick & Dominick, after graduating with a bachelor's degree from Yale University in 1964. Rogers then acquired a second BA degree in Philosophy, Politics and Economics from Balliol College, Oxford University in 1966.

In 1970, Rogers joined Arnhold and S. Bleichroder. In 1973, Rogers co-founded the Quantum Fund with George Soros. During the following 10 years, the portfolio gained 4200% while the S&P advanced about 47%.[4] The Quantum Fund was one of the first truly international funds.

[from Wikipedia] Rogers was born in Baltimore, Maryland and raised in Demopolis, Alabama.[1][3] He started in business at the age of five by selling peanuts and by picking up empty bottles that fans left behind at baseball games. He got his first job on Wall Street, at Dominick & Dominick, after graduating with a bachelor's degree from Yale University in 1964. Rogers then acquired a second BA degree in Philosophy, Politics and Economics from Balliol College, Oxford University in 1966.

In 1970, Rogers joined Arnhold and S. Bleichroder. In 1973, Rogers co-founded the Quantum Fund with George Soros. During the following 10 years, the portfolio gained 4200% while the S&P advanced about 47%.[4] The Quantum Fund was one of the first truly international funds.

Labels:

cds's,

CNBC Today,

crash now,

greek debt,

Jimmy Rogers,

trading again,

yale

Friday, June 10, 2011

Monday, May 30, 2011

Sunday, May 29, 2011

Friday, May 27, 2011

Tuesday, May 24, 2011

Cramer's New List -- Before the Market Will Rally

#1 Suggestion

First, I wish Greece would just default already. It's so inevitable. If this happened, think about it, we could rethink this whole process. Let some of these European banks that own too much of this bad government debt go out of business. They never raised the capital that our banks did anyway. It's time for Europe to take the medicine, and get with the program. We all will survive this default. But this finger-in-the-dike nonsense must end once and for all. A failure of imagination. Come up with a two-tier currency. I don't care. Let's move on.

#2 Suggestion

Second, I wish the federal government would force the exchanges here to raise the margin rates on oil. All the President has to do is suggest... and believe me, the exchanges would cave. You could send oil prices down to $85 in a nanosecond. I wish I could guarantee something, but I'll tell you something, this would happen... And then what would happen? Gasoline, down to $3.25. An immediate spending impetus for the whole country. Recharge the nation.

#3 Suggestion

Third, I wish China would recognize that the inflation side of things isn't as important right now. They just had a bad industrial number that came out last night. The slowdown... they're engineering a slowdown... Maybe enough is enough, central bank. The whole commodity complex is collapsing. The Chinese seem a little oblivious. Love those guys, but come one. The world needs your help.

#4 Suggestion

Fourth, I wish the US government would take advantage of these incredibly low long-term interest rates and refinance its debt, so that we don't have to worry about the IMF someday coming here, because we can't roll over our short-term paper. That is the current Grecian problem. The Treasury Secretary could be a hero for this. He seems to be willing to sacrifice long-term considerations for short-term borrowing costs. I know. I've heard him say it. $200 billion. You know what? A small price to pay, versus having the IMF here. Come on, Tim, you're better than that. I know you are. You're one of the good guys.

#5 Suggestion

Fifth, I wish that we could recognize the opportunity that the glut of natural gas in this country represents... an opportunity to choke off OPEC by forcing trucks to switch from diesel fuel to liquefied natural gas.

#6 Suggestion

Sixth, I wish stocks would just get where they have to go... to levels where the values are so obvious that they would have to be taken. That would require them to become accidental high yielders, giving people a chance to earn some income while they own stocks. Hey, you know something? It's already starting to happen. Have you seen where Nucor, the great steel company, is? It now yields 3.5%. Most stocks have further to fall, and endless bidding up of the staples... it's now beyond reason. I mean, come on.

#7 Suggestion

Seventh... oh here's a tough one... I wish the underwriters who started a social media bubble last week, with their ridiculous under pricing of LinkedIn, would be castigated by the SEC. The SEC always takes a handoff approach to this stuff. It was so obvious that this moronic deal would cause another bubble, that I know it made me feel much more negative about stocks than I like. Believe me, there's nothing inevitable about the social media bubble. We are not doomed to repeat the mistakes of the dot-com era. It can be stopped. Come on, government. Get your hands dirty. Get involved. You're involved with the bank and mortgages. Get involved with underwriting before it's too late, and the whole dot-bomb process begins again, ruining the asset class that is stocks, even more than it already is.

#8 Suggestion

Eighth, I wish people would stop trashing Ben Bernanke. He is single-handedly keeping the financial system afloat, against an onslaught of foreclosed properties that are crushing the banks' balance sheets. Bernanke's been the best Fed Chairman of our lifetime. Give the guy a break.

#9 Suggestion

Ninth, I wish that a bunch of these stocks that trade in triple digits would just split already. Look, I know splits are totally cosmetic... that they create no real value. But I have to tell you, these stocks are being viewed as targets of opportunity for short sellers, and they are also the easiest ways for managers to raise money. A simple split would make their stocks more stable, and accessible to homegamers before they're driven out of the game entirely.

#10 Suggestion

Finally, I wish the President would come home and say to congress, no recess until you raise the debt ceiling and agree to some big spending cuts. We have a chance, right now as a nation, to assert ourselves as the world's most financially stable place. If we could only reach some sort of major debt agreement, the world is ours to win.

The bottom line...

▼ ▼ ▼ ▼

How outrageous is my wish list... as outrageous as it is common sensical... Everybody in this market knows that every one of these open-ended issues, and the problems they are causing for stocks. And until they are resolved, we can't rally. It's too bad, because we could easily take out the highs, if we got all 10 of these points. Then again though, this asset class has no supporters in Washington these days. So don't hold your breath. I say let the market come down until we get some of these points resolved. And then find yourself in a great situation, and great shape, to take advantage of the aftermath.

First, I wish Greece would just default already. It's so inevitable. If this happened, think about it, we could rethink this whole process. Let some of these European banks that own too much of this bad government debt go out of business. They never raised the capital that our banks did anyway. It's time for Europe to take the medicine, and get with the program. We all will survive this default. But this finger-in-the-dike nonsense must end once and for all. A failure of imagination. Come up with a two-tier currency. I don't care. Let's move on.

#2 Suggestion

Second, I wish the federal government would force the exchanges here to raise the margin rates on oil. All the President has to do is suggest... and believe me, the exchanges would cave. You could send oil prices down to $85 in a nanosecond. I wish I could guarantee something, but I'll tell you something, this would happen... And then what would happen? Gasoline, down to $3.25. An immediate spending impetus for the whole country. Recharge the nation.

#3 Suggestion

Third, I wish China would recognize that the inflation side of things isn't as important right now. They just had a bad industrial number that came out last night. The slowdown... they're engineering a slowdown... Maybe enough is enough, central bank. The whole commodity complex is collapsing. The Chinese seem a little oblivious. Love those guys, but come one. The world needs your help.

#4 Suggestion

Fourth, I wish the US government would take advantage of these incredibly low long-term interest rates and refinance its debt, so that we don't have to worry about the IMF someday coming here, because we can't roll over our short-term paper. That is the current Grecian problem. The Treasury Secretary could be a hero for this. He seems to be willing to sacrifice long-term considerations for short-term borrowing costs. I know. I've heard him say it. $200 billion. You know what? A small price to pay, versus having the IMF here. Come on, Tim, you're better than that. I know you are. You're one of the good guys.

#5 Suggestion

Fifth, I wish that we could recognize the opportunity that the glut of natural gas in this country represents... an opportunity to choke off OPEC by forcing trucks to switch from diesel fuel to liquefied natural gas.

#6 Suggestion

Sixth, I wish stocks would just get where they have to go... to levels where the values are so obvious that they would have to be taken. That would require them to become accidental high yielders, giving people a chance to earn some income while they own stocks. Hey, you know something? It's already starting to happen. Have you seen where Nucor, the great steel company, is? It now yields 3.5%. Most stocks have further to fall, and endless bidding up of the staples... it's now beyond reason. I mean, come on.

#7 Suggestion

Seventh... oh here's a tough one... I wish the underwriters who started a social media bubble last week, with their ridiculous under pricing of LinkedIn, would be castigated by the SEC. The SEC always takes a handoff approach to this stuff. It was so obvious that this moronic deal would cause another bubble, that I know it made me feel much more negative about stocks than I like. Believe me, there's nothing inevitable about the social media bubble. We are not doomed to repeat the mistakes of the dot-com era. It can be stopped. Come on, government. Get your hands dirty. Get involved. You're involved with the bank and mortgages. Get involved with underwriting before it's too late, and the whole dot-bomb process begins again, ruining the asset class that is stocks, even more than it already is.

#8 Suggestion

Eighth, I wish people would stop trashing Ben Bernanke. He is single-handedly keeping the financial system afloat, against an onslaught of foreclosed properties that are crushing the banks' balance sheets. Bernanke's been the best Fed Chairman of our lifetime. Give the guy a break.

#9 Suggestion

Ninth, I wish that a bunch of these stocks that trade in triple digits would just split already. Look, I know splits are totally cosmetic... that they create no real value. But I have to tell you, these stocks are being viewed as targets of opportunity for short sellers, and they are also the easiest ways for managers to raise money. A simple split would make their stocks more stable, and accessible to homegamers before they're driven out of the game entirely.

#10 Suggestion

Finally, I wish the President would come home and say to congress, no recess until you raise the debt ceiling and agree to some big spending cuts. We have a chance, right now as a nation, to assert ourselves as the world's most financially stable place. If we could only reach some sort of major debt agreement, the world is ours to win.

The bottom line...

▼ ▼ ▼ ▼

How outrageous is my wish list... as outrageous as it is common sensical... Everybody in this market knows that every one of these open-ended issues, and the problems they are causing for stocks. And until they are resolved, we can't rally. It's too bad, because we could easily take out the highs, if we got all 10 of these points. Then again though, this asset class has no supporters in Washington these days. So don't hold your breath. I say let the market come down until we get some of these points resolved. And then find yourself in a great situation, and great shape, to take advantage of the aftermath.

Labels:

cramer last night

Thursday, May 19, 2011

Wednesday, May 18, 2011

Tech Tip -- Don't Pay For Antivirus Program Again

¶ You don’t have to pay for antivirus and anti-spyware software, year after year. Microsoft offers a perfectly good free security program. http://www.microsoft.com/en-us/security_essentials/default.aspx

Labels:

tech tips

Jim Cramer Hits an All-Time High

(c) 2011 F. Bruce Abel

This article on Jim Cramer is just "ok," providing a modicum of new information, such as that he divorced The Trading Goddess, which I had deduced by his repeated references of life of "Friday night drinking drinking cheap scotch on the dirty linoleum floor" and other comments about his weekends and life.

The article does not give Cramer the praise that his portfolio deserves, as its performance is sensational. But there are "flaws" in his nightly presentation theory -- a little slippery about whether he called this correction or that one, etc. Such problems are inherent in what he is doing. I have never really made money "following" him, due to psychological factors that I think everybody feels.

Cramer says he is a Democrat but when he was on CNBC with Kudlow (pre Mad Money) he was pretty Wall Street/Republican-line, I thought.

http://www.nytimes.com/2011/05/15/magazine/jim-cramer-hits-an-all-time-high.html?hpw

This article on Jim Cramer is just "ok," providing a modicum of new information, such as that he divorced The Trading Goddess, which I had deduced by his repeated references of life of "Friday night drinking drinking cheap scotch on the dirty linoleum floor" and other comments about his weekends and life.

The article does not give Cramer the praise that his portfolio deserves, as its performance is sensational. But there are "flaws" in his nightly presentation theory -- a little slippery about whether he called this correction or that one, etc. Such problems are inherent in what he is doing. I have never really made money "following" him, due to psychological factors that I think everybody feels.

Cramer says he is a Democrat but when he was on CNBC with Kudlow (pre Mad Money) he was pretty Wall Street/Republican-line, I thought.

http://www.nytimes.com/2011/05/15/magazine/jim-cramer-hits-an-all-time-high.html?hpw

Labels:

Cramer Today

First "Hot Air" Entry For Awhile

Imagine your breakfast and lose ten pounds!

http://www.nytimes.com/2011/05/18/dining/treats-without-calories-imagine-that.html

http://www.nytimes.com/2011/05/18/dining/treats-without-calories-imagine-that.html

Labels:

Hot Air

Wednesday, May 11, 2011

Random Notes

Randum notes of May 11, 2011 copied or spiked:

Loan Limits Effect on Counties

http://www.nytimes.com/interactive/2011/05/11/business/20110511housingCounties.html?ref=business

Modern Life on Tobacco Road

Foremost Ins. Co. v. Rudolph

In May of 2010, Cynthia lived in a 1996 Fleetwood mobile home located in Lowndes County, Alabama near Highway 80. Cynthia lived with four of her eight children: Emily (age 19), Karmen Rudolph (age 18), Jacora Brown (16), and Fantavia Brown (14). Emily's two daughters, Alivia (age 4 months) and Alkera (age 2), also lived in the mobile home.

Cynthia earned some income from gambling either with her own money or with other people's money.1 [*6] She earned about $10,000 from gambling in the year before preceding May of 2010. She also sold food such as hamburgers and chicken strips from an unlicensed concession stand near the mobile home. She earned about $400 a month doing so. Cynthia's friends Rick Graham ("Graham") and Roosevelt Williams ("Williams") financially assisted Cynthia and her family. In fact, Graham gave Cynthia and her daughters the mobile home in which they lived.2 As of May of 2010, Cynthia had outstanding federal tax liens against her for $18,213 for 2004; $29,496 for 2003; and $2,120 for 1998.

1 In 2007, Cynthia hit a $1,000,000 jackpot while gambling. She purchased cars, a boat, an excavator, her concession, new televisions and appliances and her concession stand before a man with whom she had been romantically involved disappeared with $800,000 of the money. Cynthia did not file an income tax return for 2007, nor did she pay income taxes on the jackpot. The IRS is pursuing her for taxes she should have paid on her winnings in 2007.

2 There is some conflict in the testimony about legal title to the mobile home. Emily testified that the title for the mobile home was in her name jointly with Graham. Cynthia seemed [*7] to indicate that it was in the name of Emily alone Emily and her sisters, but that Graham intended the mobile home to be used by Cynthia and her daughters. There is also some conflicting information in the record about the ownership of the land on which the mobile home was located. Emily claims Graham gave it to her along with the mobile home. Graham indicates that he continues to own the land but did not charge Cynthia and her children to reside in the mobile home on his land.

Emily has never been employed. She received only $358 a month in food stamps. In 2010, she had several outstanding debts which were in the collection process. The total sum owed on these debts exceeded $14,000.

For several months, Emily did not have insurance on the mobile home. When Emily's younger sister Karmen started a job as a Census Worker, Emily decided to obtain insurance on the mobile home. On April 12, 2010, Emily called Foremost to obtain insurance on the mobile home. Foremost took her application and payment over the phone. Emily asked when the policy would be effective. The Foremost representative told her that it could be effective that day if the payment was made over the phone. Emily and Karmen [*8] arranged for the initial payment to be taken out of Karmen's bank account.

Foremost issued a policy providing insurance of $80,000 on the mobile home, $43,000 for personal property within the home, and $15,000 for other structures. Foremost has identified several policy provisions that are key to the resolution of this motion. Those provisions are as follows:

SECTION 1 - Insured Perils

We insure risk of direct, sudden and accidental physical loss to the property described in Coverage A - Dwelling, Coverage B - Other Structures and Coverage C - Personal Property unless the loss is excluded elsewhere in this policy.

* * * *

Doc. 18 at Ex. A- 1.

On the afternoon of May 11, 2010, the mobile home burned. At the time of the fire, the mobile home was unoccupied. Cynthia was nearby at the concession stand. Two of Emily's younger sisters had come home from school and taken Emily's children on a walk to a nearby store. Emily put a load of clothes into the dryer. Rather than going to her mother's nearby concession stand, Emily decided to drive to the White Hall Triple Spot Restaurant, which was located five or ten miles away, to pick up a cheese hamburger. When Emily left, she made sure she locked the mobile home.

A relative of hers, Tracy Smith ("Smith") was working on the brakes of his car nearby, and she told him she was going to get some food. After Emily left the mobile home, Smith did not see anyone enter or leave the mobile. Smith heard a smoke alarm sounding inside the mobile home. He looked [*10] into the mobile home and saw fire. He tried to extinguish the fire by breaking out a window and spraying water from a hose. He also called 911. A man who was passing by stopped to help Smith try to stop the fire. The fire department arrived and extinguished the flames. The mobile home was rendered a total loss.

When Emily returned from picking up her cheese burger, she saw the fire department, ambulance, and many cars near her mobile home. She realized her mobile home was on fire. It is not clear who contacted Foremost to report the fire and make a claim, but it is clear that someone informed Foremost about the fire and that both Cynthia and Emily had dealings with Foremost relating to the insurance claim for the loss of the mobile home and its contents. Both Emily and Cynthia indicated that they did not know how the fire had started.

Foremost issued a number of checks to Emily to pay the family's emergency living expenses after the fire. Foremost also began to investigate the cause and origin of the fire. It hired Troy Ammons ("Ammons"), a Certified

Etc., etc., etc.

[they -- Cynthia and Emily -- lost]

Foremost Ins. Co. v. Rudolph, 2011 U.S. Dist. LEXIS 49551 (D. Ala. 2011)

Loan Limits Effect on Counties

http://www.nytimes.com/interactive/2011/05/11/business/20110511housingCounties.html?ref=business

Modern Life on Tobacco Road

Foremost Ins. Co. v. Rudolph

In May of 2010, Cynthia lived in a 1996 Fleetwood mobile home located in Lowndes County, Alabama near Highway 80. Cynthia lived with four of her eight children: Emily (age 19), Karmen Rudolph (age 18), Jacora Brown (16), and Fantavia Brown (14). Emily's two daughters, Alivia (age 4 months) and Alkera (age 2), also lived in the mobile home.

Cynthia earned some income from gambling either with her own money or with other people's money.1 [*6] She earned about $10,000 from gambling in the year before preceding May of 2010. She also sold food such as hamburgers and chicken strips from an unlicensed concession stand near the mobile home. She earned about $400 a month doing so. Cynthia's friends Rick Graham ("Graham") and Roosevelt Williams ("Williams") financially assisted Cynthia and her family. In fact, Graham gave Cynthia and her daughters the mobile home in which they lived.2 As of May of 2010, Cynthia had outstanding federal tax liens against her for $18,213 for 2004; $29,496 for 2003; and $2,120 for 1998.

1 In 2007, Cynthia hit a $1,000,000 jackpot while gambling. She purchased cars, a boat, an excavator, her concession, new televisions and appliances and her concession stand before a man with whom she had been romantically involved disappeared with $800,000 of the money. Cynthia did not file an income tax return for 2007, nor did she pay income taxes on the jackpot. The IRS is pursuing her for taxes she should have paid on her winnings in 2007.

2 There is some conflict in the testimony about legal title to the mobile home. Emily testified that the title for the mobile home was in her name jointly with Graham. Cynthia seemed [*7] to indicate that it was in the name of Emily alone Emily and her sisters, but that Graham intended the mobile home to be used by Cynthia and her daughters. There is also some conflicting information in the record about the ownership of the land on which the mobile home was located. Emily claims Graham gave it to her along with the mobile home. Graham indicates that he continues to own the land but did not charge Cynthia and her children to reside in the mobile home on his land.

Emily has never been employed. She received only $358 a month in food stamps. In 2010, she had several outstanding debts which were in the collection process. The total sum owed on these debts exceeded $14,000.

For several months, Emily did not have insurance on the mobile home. When Emily's younger sister Karmen started a job as a Census Worker, Emily decided to obtain insurance on the mobile home. On April 12, 2010, Emily called Foremost to obtain insurance on the mobile home. Foremost took her application and payment over the phone. Emily asked when the policy would be effective. The Foremost representative told her that it could be effective that day if the payment was made over the phone. Emily and Karmen [*8] arranged for the initial payment to be taken out of Karmen's bank account.

Foremost issued a policy providing insurance of $80,000 on the mobile home, $43,000 for personal property within the home, and $15,000 for other structures. Foremost has identified several policy provisions that are key to the resolution of this motion. Those provisions are as follows:

SECTION 1 - Insured Perils

We insure risk of direct, sudden and accidental physical loss to the property described in Coverage A - Dwelling, Coverage B - Other Structures and Coverage C - Personal Property unless the loss is excluded elsewhere in this policy.

* * * *

Doc. 18 at Ex. A- 1.

On the afternoon of May 11, 2010, the mobile home burned. At the time of the fire, the mobile home was unoccupied. Cynthia was nearby at the concession stand. Two of Emily's younger sisters had come home from school and taken Emily's children on a walk to a nearby store. Emily put a load of clothes into the dryer. Rather than going to her mother's nearby concession stand, Emily decided to drive to the White Hall Triple Spot Restaurant, which was located five or ten miles away, to pick up a cheese hamburger. When Emily left, she made sure she locked the mobile home.

A relative of hers, Tracy Smith ("Smith") was working on the brakes of his car nearby, and she told him she was going to get some food. After Emily left the mobile home, Smith did not see anyone enter or leave the mobile. Smith heard a smoke alarm sounding inside the mobile home. He looked [*10] into the mobile home and saw fire. He tried to extinguish the fire by breaking out a window and spraying water from a hose. He also called 911. A man who was passing by stopped to help Smith try to stop the fire. The fire department arrived and extinguished the flames. The mobile home was rendered a total loss.

When Emily returned from picking up her cheese burger, she saw the fire department, ambulance, and many cars near her mobile home. She realized her mobile home was on fire. It is not clear who contacted Foremost to report the fire and make a claim, but it is clear that someone informed Foremost about the fire and that both Cynthia and Emily had dealings with Foremost relating to the insurance claim for the loss of the mobile home and its contents. Both Emily and Cynthia indicated that they did not know how the fire had started.

Foremost issued a number of checks to Emily to pay the family's emergency living expenses after the fire. Foremost also began to investigate the cause and origin of the fire. It hired Troy Ammons ("Ammons"), a Certified

Etc., etc., etc.

[they -- Cynthia and Emily -- lost]

Foremost Ins. Co. v. Rudolph, 2011 U.S. Dist. LEXIS 49551 (D. Ala. 2011)

Labels:

Home Buyer,

randum notes; Hot Air

Tuesday, May 10, 2011

Sunday, May 1, 2011

Friday, April 29, 2011

Comments on NYT Article Today -- Read!

7.

joe

NY

April 29th, 2011

11:48 amThe credit default swaps market didn't used to exist! Okay? And the global financial world functioned very well without it. Was dramatically safer, in fact. It is simply impossible to make the argument that giving big banks the ability to secretely bet against bondholders serves any essential purpose. But the important thing to remember is that those bets would no longer be attractive or valuable if transparency was required.

Louise Story has done some tremendous work on this subject, but I strongly take issue with the description of the OTC derivatives market as a "corner" of the financial world. At $600 trillion, it dwarfs all other activity. Major players in this market have trading floors as big as football fields devoted entirely to derivatives. It's not a corner, it's the whole house, and it is rotten to the core.

I'm glad the European Commission is saying these things. Political leaders and regulators in America, the epicenter of derivatives activity, should be saying this. But there is no such thing as transparency and safety in this casino. The OTC market would not have grown into the cancerous beast it became if there had been transparency all along. You cannot have a game of poker if everyone has to show their hands from the start. The market is DEPENDANT on secrecy and danger because it is gambling, not risk management, for crying out loud. It also became massively popular because it was such a profitable way to predate on less sophisticated counterparties, entire countries, sometimes. It is also institutionalized tax evasion and accounting fraud. If you bring it into the light, you kill its purpose.

It is also a gross misrepresentation to say that derivatives only "added to the panic during the financial crisis". Derivatives directly CAUSED the financial crisis! They took down Bear and Lehman and Merrill and AIG and Greece and Iceland and Ireland, and countless others, just as they had devastated or destroyed LTCM, Japan, Russia, Mexico, Argentina, Orange County, Barings, Sumitomo and others in years past.

Read Steinherr and Partnoy and Das and a host of others.Recommend Recommended by 13 Readers

joe

NY

April 29th, 2011

11:48 amThe credit default swaps market didn't used to exist! Okay? And the global financial world functioned very well without it. Was dramatically safer, in fact. It is simply impossible to make the argument that giving big banks the ability to secretely bet against bondholders serves any essential purpose. But the important thing to remember is that those bets would no longer be attractive or valuable if transparency was required.

Louise Story has done some tremendous work on this subject, but I strongly take issue with the description of the OTC derivatives market as a "corner" of the financial world. At $600 trillion, it dwarfs all other activity. Major players in this market have trading floors as big as football fields devoted entirely to derivatives. It's not a corner, it's the whole house, and it is rotten to the core.

I'm glad the European Commission is saying these things. Political leaders and regulators in America, the epicenter of derivatives activity, should be saying this. But there is no such thing as transparency and safety in this casino. The OTC market would not have grown into the cancerous beast it became if there had been transparency all along. You cannot have a game of poker if everyone has to show their hands from the start. The market is DEPENDANT on secrecy and danger because it is gambling, not risk management, for crying out loud. It also became massively popular because it was such a profitable way to predate on less sophisticated counterparties, entire countries, sometimes. It is also institutionalized tax evasion and accounting fraud. If you bring it into the light, you kill its purpose.

It is also a gross misrepresentation to say that derivatives only "added to the panic during the financial crisis". Derivatives directly CAUSED the financial crisis! They took down Bear and Lehman and Merrill and AIG and Greece and Iceland and Ireland, and countless others, just as they had devastated or destroyed LTCM, Japan, Russia, Mexico, Argentina, Orange County, Barings, Sumitomo and others in years past.

Read Steinherr and Partnoy and Das and a host of others.Recommend Recommended by 13 Readers

Sunday, April 24, 2011

Subscribe to:

Comments (Atom)

Labels

- Civil Society (478)

- Liar's Poker by Michael Lewis (342)

- Hot Air (327)

- Heating Degree Days (160)

- Good Writing (153)

- natural gas (148)

- Deregulation of Electricity (139)

- Cramer Yesterday (134)

- Paul Krugman (128)

- Masters of the Universe (102)

- baselinescenerio.com (101)

- Countrywide (95)

- madoff (88)

- tech tips (76)

- aggregation (72)

- health care (63)

- trading again (63)

- Saakashvilli (59)

- Duke Energy (58)

- Trading Natural Gas and Other Futures and Derivatives (58)

- bailout (55)

- friedman (53)

- David Brooks (52)

- e-bills (52)

- Not Hot Air (51)

- simon johnson (50)

- Home Buyer (45)

- goldman sachs. (45)

- Leverage (43)

- Bear Stearns (39)

- Gretchen Morgenson (36)

- aig (36)

- herbert (35)

- real estate (33)

- GE (29)

- derivatives (29)

- Cramer Today (28)

- confessions of a pattern day-trader (28)

- gs (28)

- 885 Greenville (27)

- etf's (27)

- brooks (26)

- CNBC Today (25)

- Crash of 1987 (24)

- Rush Limbaugh (24)

- rich (23)

- How to Read This Blog (22)

- saackashvili (22)

- crash now (21)

- Clarence Thomas (20)

- kristoff (20)

- Nocera (19)

- William F. Buckley Jr. (18)

- cohen (17)

- credit default swaps (17)

- dowd (17)

- lehman (17)

- The Big Short by Michael Lewis (16)

- citicorp (16)

- hedge funds (16)

- obama (16)

- Charlie Rose (15)

- collins (15)

- cramer last night (15)

- globe_mail (15)

- banks (14)

- dreier (14)

- flynn's oil (14)

- georgia (14)

- kristol (14)

- Banc of America (13)

- Cramer and October 8 (13)

- Gold (13)

- Jimmy Rogers (13)

- The Current Stock Market and Reporting Therein (13)

- Warren Buffett (13)

- geithner (13)

- Bill Gross (12)

- Norris (12)

- Value of Diversification (12)

- c (12)

- fifth third (12)

- stimulus plan (12)

- American Energy (11)

- Auchincloss (11)

- bill moyers (11)

- david f swensen (11)

- humor (11)

- margaret wente (11)

- nakedshorts (11)

- pattern day trader (11)

- Ah Enron (10)

- alternative investments (10)

- yale (10)

- Energy Savings for Residential Home (9)

- Paulson (9)

- aig.credit default swaps (9)

- bond funds (9)

- investment advisors (9)

- realtors(R) (9)

- toxic (9)

- Misleading CNBC Ads (8)

- Why I Was Too Busy (8)

- canada (8)

- carlos celdran (8)

- consuelo mack (8)

- dead_of_winter (8)

- fifth_third (8)

- jp morgan (8)

- larry summers (8)

- morgan stanley (8)

- rubin (8)

- wolfe (8)

- Amaranth (7)

- Barefoot Advertising (7)

- Cooling Degree Days (7)

- Glengarry (7)

- Judge Cudahy (7)

- No Hot Air smart grid (7)

- Weakening Dollar (7)

- james kwak (7)

- pogue (7)

- reflects (7)

- symmes township (7)

- what we learn when special people die (7)

- Municipality Bankruptcies (6)

- Notary Signing Agents (6)

- Private Equity (6)

- andrew ross serkin (6)

- bogle of vanguard (6)

- civil rights (6)

- fannie and freddie (6)

- gm (6)

- health (6)

- italy (6)

- keynes (6)

- mortgage brokers (6)

- stan chesley (6)

- susan boyle (6)

- volker (6)

- ; CNBC Today (5)

- Actual Laurel and Greenville (5)

- Cost Per Megawatt (5)

- Deregulation (5)

- Judith Warner (5)

- Merrill Lynch (5)

- Phil Gramm (5)

- The Dollar (5)

- auction rate securities (5)

- bonds (5)

- cramer's crash checklist 2010 (5)

- credit cards (5)

- dan gearino (5)

- dominion (5)

- dulley (5)

- high frequency trading (5)

- iou (5)

- iran (5)

- john lanchester (5)

- joseph cassano (5)

- kesselschlacht (5)

- libor (5)

- mybesttime (5)

- natural gas is not like oil (5)

- palin (5)

- philippines (5)

- sec (5)

- stanford (5)

- ted kennedy (5)

- Gail Collins (4)

- Hunter S. Thompson (4)

- Si burick (4)

- US Dollar (4)

- art cashin (4)

- blow (4)

- buffett (4)

- don marshall (4)

- dwell (4)

- economics (4)

- finances (4)

- fraud (4)

- green township (4)

- grisham (4)

- harry markopolos (4)

- heating oil (4)

- hillary (4)

- investment banks (4)

- john c bogle (4)

- pajama traders (4)

- rider fpp (4)

- soros. friedman (4)

- sotomayor (4)

- subprime meltdown (4)

- supreme court (4)

- tarp (4)

- where we live out lives (4)

- 1998 (3)

- 970 laurel (3)

- Fiscal Stimulous (3)

- Paul Newman (3)

- Reich (3)

- The Associate (3)

- Thomas Frank (3)

- What a Ride Ye Gave Thee Shareholders (3)

- ackman (3)

- bp (3)

- burry (3)

- calvin trillin (3)

- carlos slim. masters of the universe (3)

- cdo (3)

- cds's (3)

- checklist (3)

- christopher buckley (3)

- collapse (3)

- commodities (3)

- david muth (3)

- doug worple (3)

- duhigg (3)

- duke energy retail sales llc (3)

- elizabeth warren (3)

- euro (3)

- flash crash (3)

- g-20 (3)

- glendale (3)

- goolsbee (3)

- gs; Liar's Poker by Michael Lewis (3)

- gs; goldman sachs. (3)

- hank greenberg (3)

- institutional investor (3)

- insurance companies (3)

- law firms (3)

- manila (3)

- mcnees (3)

- meredith whitney (3)

- middle east (3)

- movies (3)

- new yorker (3)

- option arms (3)

- paul daugherty (3)

- procter (3)

- reagan (3)

- ritchard posner (3)

- steve martin (3)

- stimulous plan (3)

- terrorism (3)

- toqueville (3)

- trust (3)

- wendell potter (3)

- words (3)

- Bernie schaeffer (2)

- Buddy (2)

- Editor's Selection (2)

- Frank DeFord (2)

- Gasparino (2)

- George Vecsey (2)

- Geothermal (2)

- God (2)

- Greenspan (2)

- Latest Carry Trade (2)

- Railroads (2)

- Remnick (2)

- Rich.reflects (2)

- Spitzer (2)

- The Very Crux (2)

- Wachovia (2)

- Weather Futures (2)

- a heddgie (2)

- abacus (2)

- aep (2)

- andreww ross serkin (2)

- arthur nadel (2)

- auto task force (2)

- barcelona (2)

- barrons (2)

- barton (2)

- bernanke (2)

- beth smith (2)

- biden (2)

- bill black (2)

- black swan (2)

- blood pressure (2)

- bridge (2)

- brooks-Simon (2)

- bruce abel (2)

- bubbles (2)

- cheever (2)

- chris dodd (2)

- christopher walken (2)

- community reinvestment act (2)

- corporate bonds (2)

- cramer's list (2)

- crash of 1929 (2)

- crash of 2:45 p.m. (2)

- cursing mommy (2)

- daugherty (2)

- donttrythisonyourhome.blogspot.com (2)

- duk (2)

- economix (2)

- entrepreneur (2)

- eu (2)

- fasb (2)

- fast money last night (2)

- financial advisors (2)

- financial crisis inquiry commission (2)

- fool's gold (2)

- glanville (2)

- glass-steagall (2)

- guessing cramer (2)

- hal mcCoy (2)

- house of cards (2)

- hugh laury (2)

- ian frazier (2)

- imf (2)

- immelt (2)

- indymac (2)

- iolta (2)

- jamie dimon (2)

- jimmy cayne (2)

- john mack (2)

- kellerman (2)

- lobbying (2)

- loonie (2)

- magnetar (2)

- marcellus shale (2)

- marselus shale (2)

- mcCain (2)

- medicare (2)

- merton.mit (2)

- milton friedman (2)

- neil bortz (2)