Monday, December 24, 2007

Glengarry Glen Ross

To understand the environment in New York that caused the subprime disaster, rent the movie Glengarry Glen Ross, starring Jack Lemmon, Kevin Spacy, etc., a 1992 movie.

When one's job is to sell, sell, sell, and your/family's survival is on the line, you sell, sell, sell. The product is immaterial. The interest of the buyer is immaterial. You screw your co-workers, your superiors, etc.

Also, as readers of this Blog know, the concept is best discussed by Michael Lewis in Liar's Poker, and if you click on this Label (Liar's Poker) you will see the key quote quoted multiple times.

Also Richard Cudahy, the judge, hits on it from an administrative point of view in the electric utility field. Again, click on that Label (Judge Cudahy).

Krugman Today

Paul Krugman has a way of discussing very complex thoughts which must be understood if we are to avoid other disasters like the last seven years. He is also documenting how the political system boxes in the candidates into taking positions which are against the interests of the constituents they want to help.

Today's discussion is just brilliant and deserves a lot of thought.

--------------------------------------------------------------------------------

December 24, 2007

Op-Ed Columnist

State of the Unions

By PAUL KRUGMAN

Once upon a time, back when America had a strong middle class, it also had a strong union movement.

These two facts were connected. Unions negotiated good wages and benefits for their workers, gains that often ended up being matched even by nonunion employers. They also provided an important counterbalance to the political influence of corporations and the economic elite.

Today, however, the American union movement is a shadow of its former self, except among government workers. In 1973, almost a quarter of private-sector employees were union members, but last year the figure was down to a mere 7.4 percent.

Yet unions still matter politically. And right now they’re at the heart of a nasty political scuffle among Democrats. Before I get to that, however, let’s talk about what happened to American labor over the last 35 years.

It’s often assumed that the U.S. labor movement died a natural death, that it was made obsolete by globalization and technological change. But what really happened is that beginning in the 1970s, corporate America, which had previously had a largely cooperative relationship with unions, in effect declared war on organized labor.

Don’t take my word for it; read Business Week, which published an article in 2002 titled “How Wal-Mart Keeps Unions at Bay.” The article explained that “over the past two decades, Corporate America has perfected its ability to fend off labor groups.” It then described the tactics — some legal, some illegal, all involving a healthy dose of intimidation — that Wal-Mart and other giant firms use to block organizing drives.

These hardball tactics have been enabled by a political environment that has been deeply hostile to organized labor, both because politicians favored employers’ interests and because conservatives sought to weaken the Democratic Party. “We’re going to crush labor as a political entity,” Grover Norquist, the anti-tax activist, once declared.

But the times may be changing. A newly energized progressive movement seems to be on the ascendant, and unions are a key part of that movement. Most notably, the Service Employees International Union has played a key role in pushing for health care reform. And unions will be an important force in the Democrats’ favor in next year’s election.

Or maybe not — which brings us to the latest from Iowa.

Whoever receives the Democratic presidential nomination will receive labor’s support in the general election. Meanwhile, however, unions are supporting favored candidates. Hillary Clinton — who for a time seemed the clear front-runner — has received the most union support. John Edwards, whose populist message resonates with labor, has also received considerable labor support.

But Barack Obama, though he has a solid pro-labor voting record, has not — in part, perhaps, because his message of “a new kind of politics” that will transcend bitter partisanship doesn’t make much sense to union leaders who know, from the experience of confronting corporations and their political allies head on, that partisanship isn’t going away anytime soon.

O.K., that’s politics. But now Mr. Obama has lashed out at Mr. Edwards because two 527s — independent groups that are allowed to support candidates, but are legally forbidden from coordinating directly with their campaigns — are running ads on his rival’s behalf. They are, Mr. Obama says, representative of the kind of “special interests” that “have too much influence in Washington.”

The thing, though, is that both of these 527s represent union groups — in the case of the larger group, local branches of the S.E.I.U. who consider Mr. Edwards the strongest candidate on health reform. So Mr. Obama’s attack raises a couple of questions.

First, does it make sense, in the current political and economic environment, for Democrats to lump unions in with corporate groups as examples of the special interests we need to stand up to?

Second, is Mr. Obama saying that if nominated, he’d be willing to run without support from labor 527s, which might be crucial to the Democrats? If not, how does he avoid having his own current words used against him by the Republican nominee?

Part of what happened here, I think, is that Mr. Obama, looking for a stick with which to beat an opponent who has lately acquired some momentum, either carelessly or cynically failed to think about how his rhetoric would affect the eventual ability of the Democratic nominee, whoever he or she is, to campaign effectively. In this sense, his latest gambit resembles his previous echoing of G.O.P. talking points on Social Security.

Beyond that, the episode illustrates what’s wrong with campaigning on generalities about political transformation and trying to avoid sounding partisan.

It may be partisan to say that a 527 run by labor unions supporting health care reform isn’t the same thing as a 527 run by insurance companies opposing it. But it’s also the simple truth.

Saturday, December 22, 2007

Bob Herbert Today

This too is an important article/editorial.

--------------------------------------------------------------------------------

December 22, 2007

Op-Ed Columnist

Nightmare Before Christmas

By BOB HERBERT

Christmastime is bonus time on Wall Street, and the Gucci set has been blessed with another record harvest.

Forget the turbulence in the financial markets and the subprime debacle. Forget the dark clouds of a possible recession. Bloomberg News tells us that the top securities firms are handing out nearly $38 billion in seasonal bonuses, the highest total ever.

But there’s a reason to temper the celebration, if only out of respect for an old friend who’s not doing too well. Even as the Wall Streeters are high-fiving and ordering up record shipments of Champagne and caviar, the American dream is on life-support.

I had a conversation the other day with Andrew Stern, president of the Service Employees International Union. He mentioned a poll of working families that had shown that their belief in that mythical dream that has sustained so many generations for so long is fading faster than sunlight on a December afternoon.

The poll, conducted by Lake Research Partners for the Change to Win labor federation, found that only 16 percent of respondents believed that their children’s generation would be better off financially than their own. While some respondents believed that the next generation would fare roughly the same as this one, nearly 50 percent held the exceedingly gloomy view that today’s children would be “worse off” when the time comes for them to enter the world of work and raise their own families.

That absence of optimism is positively un-American.

“These are parents who cannot see where the jobs of the future are that will allow their kids to have a better life than they had,” said Mr. Stern. “And they’re not wrong. That’s the problem.”

Record bonuses on Wall Street at a time when ordinary working Americans are filled with anxiety about their economic future are signs that the trickle-down phenomenon that was supposed to have benefited everyone never happened.

The rich, boosted by the not-so-invisible hand of the corporate ideologues in government, have done astonishingly well in recent decades, while the rest of the population has tended to tread water economically, or drown.

A study released last month by the Pew Charitable Trusts noted that “for most Americans, seeing that one’s children are better off than oneself is the essence of living the American dream.” But for the past 40 years, men in their 30s, prime family-raising age, have found it difficult to outdistance their dads economically.

As the Pew study put it: “Earnings of men in their 30s have remained surprisingly flat over the past four decades.” Family incomes have improved during that time largely because of the wholesale entrance of women into the work force.

For the very wealthy, of course, it’s been a different story. According to the Congressional Budget Office, the after-tax income of the top 1 percent rose 228 percent from 1979 through 2005.

What seems to be happening now is that working Americans, and that includes the middle class, have exhausted much of their capacity to tread water. Wives and mothers are already working. Mortgages have been refinanced and tremendous amounts of home equity drained. And families have taken on debt loads — for cars, for college tuition, for medical treatment — that would buckle the knees of the strongest pack animals.

According to Demos, a policy research group in New York, “American families are using credit cards to bridge the gaps created by stagnant wages and higher costs of living.” Americans owe nearly $900 billion on their credit cards.

We’re running out of smoke and mirrors. The fundamental problem, the problem that is destroying the dream, is the extreme inequality pounded into the system by the corporate crowd and its handmaidens in government.

As Mr. Stern said: “To me, the issue in America is not a question of wealth or growth, it’s a question of distribution.”

When such an overwhelming portion of the economic benefits are skewed toward a tiny portion of the population — as has happened in the U.S. over the past few decades — it’s impossible for the society as a whole not to suffer.

Americans work extremely hard and are amazingly productive. But without the clout of a strong union movement, and arrayed against the mighty power of the corporations and the federal government, they don’t receive even a reasonably fair share of the economic benefits from their hard work or productivity.

Instead of celebrating bonuses this Christmas season, too many American workers are looking with dread toward 2008, worried about their rising levels of debt, or whether they will be able to hang on to a job with few or no benefits or how to tell their kids that they won’t be able to help with the cost of college.

It’s not the stuff of which dreams are made.

Friday, December 21, 2007

In Today's News

This is a big story. What a bunch of jerks run our money in this country.

Asian, Middle Eastern governments aid big banks

Merrill may be latest to fill holes left by write-downs with government cash

By Alistair Barr, MarketWatch

Last update: 1:48 p.m. EST Dec. 21, 2007

SAN FRANCISCO (MarketWatch) -- Some of the world's biggest banks, pinnacles of capitalist enterprise, are increasingly turning to governments in Asia and the Middle East for cash to fill gaping holes left by mortgage-related write-downs.

Several top Wall Street firms have reported heavy losses in recent weeks, confirming the effects of the subprime-fueled global credit crisis. As write-downs accumulated, more banks unveiled deals with foreign governments. See related story.

Merrill Lynch & Co. (MERMerrill Lynch & Co., Inc

MER) , the largest U.S. brokerage firm, may be the latest in search of government aid from Asia.

Temasek Holdings Pte. Ltd., an investment company owned by Singapore, is in advanced talks to inject up to $5 billion in Merrill, The Wall Street Journal reported on Friday. The report cited an unidentified person familiar with the situation.

Jessica Oppenheim, a spokeswoman for Merrill, declined to comment. Mark Lee, a spokesman for Temasek, didn't return a phone call and e-mail seeking comment on Friday.

Merrill, like several of its investment-banking rivals, has taken billions of dollars in write-downs this year as subprime mortgage-related assets, such as collateralized debt obligations, declined in value.

The firm may take another $8.6 billion in write-downs from the fourth quarter, Fox-Pitt Cochran Caronia analyst David Trone estimated on Thursday. See full story.

Earlier this week, Morgan Stanley (MSmorgan stanley com new

News, chart, profile, more MS) announced a $5 billion investment from China Investment Corp., a fund controlled by the Chinese government -- and also disclosed $5.7 billion in additional write-downs as it reported a fourth-quarter net loss of $5.8 billlion.

In similar recent deals aiding big banks in distress, Citigroup (CCitigroup, Inc C) recently sold a stake of nearly 5% to an Abu Dhabi fund for $7.5 billion and UBS (UBSUBS Ag

From American Energy

December 2007 Natural Gas Report

The natural gas market has fallen and it can't get up. Record high working storage, warm temperatures and record short futures positions on the NYMEX have combined to push the January NYMEX futures contract to new contract lows. The market sentiment is extremely bearish. On Dec 17th, the January futures contract broke below $7.00 and to a new contract low of $6.91 before bouncing back slightly. With the lack of any bullish fundamental news, noncommercial speculative investment funds on the NYMEX have continued to build unprecedented short futures positions. The most recent Commitment of Traders report revealed speculative funds hold a total short futures exposure of 185,141 contracts and a net short futures position of 92,881 contracts. To put this in perspective, the old record was 71,675 set on July 24th. As we have experienced in the past, when you have a huge position amassed on one side of the market and conditions change effecting market perception, a spike in price will occur as traders� frantically scramble to liquidate their position at the same time. In this case, should weather forecasts start showing cold air is on the way we could see a rather large spike in prices to the upside.

Krugman Today

Paul Krugmnan says he is "puzzled" by something at the end of this article. Why haven't the Democrats been more aggressive about making an issue out of this disaster in the subprime field. The answer to this "puzzle" is that Democrats are afraid to "take it to" the Republicans who have dismantled our society. The harm in every case is too staggering to face. Therefore it must be ignored.

--------------------------------------------------------------------------------

December 21, 2007

Op-Ed Columnist

Blindly Into the Bubble

By PAUL KRUGMAN

When announcing Japan’s surrender in 1945, Emperor Hirohito famously explained his decision as follows: “The war situation has developed not necessarily to Japan’s advantage.”

There was a definite Hirohito feel to the explanation Ben Bernanke, the Federal Reserve chairman, gave this week for the Fed’s locking-the-barn-door-after-the-horse-is-gone decision to modestly strengthen regulation of the mortgage industry: “Market discipline has in some cases broken down, and the incentives to follow prudent lending procedures have, at times, eroded.”

That’s quite an understatement. In fact, the explosion of “innovative” home lending that took place in the middle years of this decade was an unmitigated disaster.

But maybe Mr. Bernanke was afraid to be blunt about just how badly things went wrong. After all, straight talk would have amounted to a direct rebuke of his predecessor, Alan Greenspan, who ignored pleas to lock the barn door while the horse was still inside — that is, to regulate lending while it was booming, rather than after it had already collapsed.

I use the words “unmitigated disaster” advisedly.

Apologists for the mortgage industry claim, as Mr. Greenspan does in his new book, that “the benefits of broadened home ownership” justified the risks of unregulated lending.

But homeownership didn’t broaden. The great bulk of dubious subprime lending took place from 2004 to 2006 — yet homeownership rates are already back down to mid-2003 levels. With millions more foreclosures likely, it’s a good bet that homeownership will be lower at the Bush administration’s end than it was at the start.

Meanwhile, during the bubble years, the mortgage industry lured millions of people into borrowing more than they could afford, and simultaneously duped investors into investing vast sums in risky assets wrongly labeled AAA. Reasonable estimates suggest that more than 10 million American families will end up owing more than their homes are worth, and investors will suffer $400 billion or more in losses.

So where were the regulators as one of the greatest financial disasters since the Great Depression unfolded? They were blinded by ideology.

“Fed shrugged as subprime crisis spread,” was the headline on a New York Times report on the failure of regulators to regulate. This may have been a discreet dig at Mr. Greenspan’s history as a disciple of Ayn Rand, the high priestess of unfettered capitalism known for her novel “Atlas Shrugged.”

In a 1963 essay for Ms. Rand’s newsletter, Mr. Greenspan dismissed as a “collectivist” myth the idea that businessmen, left to their own devices, “would attempt to sell unsafe food and drugs, fraudulent securities, and shoddy buildings.” On the contrary, he declared, “it is in the self-interest of every businessman to have a reputation for honest dealings and a quality product.”

It’s no wonder, then, that he brushed off warnings about deceptive lending practices, including those of Edward M. Gramlich, a member of the Federal Reserve board. In Mr. Greenspan’s world, predatory lending — like attempts to sell consumers poison toys and tainted seafood — just doesn’t happen.

But Mr. Greenspan wasn’t the only top official who put ideology above public protection. Consider the press conference held on June 3, 2003 — just about the time subprime lending was starting to go wild — to announce a new initiative aimed at reducing the regulatory burden on banks. Representatives of four of the five government agencies responsible for financial supervision used tree shears to attack a stack of paper representing bank regulations. The fifth representative, James Gilleran of the Office of Thrift Supervision, wielded a chainsaw.

Also in attendance were representatives of financial industry trade associations, which had been lobbying for deregulation. As far as I can tell from press reports, there were no representatives of consumer interests on the scene.

Two months after that event the Office of the Comptroller of the Currency, one of the tree-shears-wielding agencies, moved to exempt national banks from state regulations that protect consumers against predatory lending. If, say, New York State wanted to protect its own residents — well, sorry, that wasn’t allowed.

Of course, now that it has all gone bad, people with ties to the financial industry are rethinking their belief in the perfection of free markets. Mr. Greenspan has come out in favor of, yes, a government bailout. “Cash is available,” he says — meaning taxpayer money — “and we should use that in larger amounts, as is necessary, to solve the problems of the stress of this.”

Given the role of conservative ideology in the mortgage disaster, it’s puzzling that Democrats haven’t been more aggressive about making the disaster an issue for the 2008 election. They should be: It’s hard to imagine a more graphic demonstration of what’s wrong with their opponents’ economic beliefs.

Friday, December 14, 2007

A Blog Worth Reading

http://norris.blogs.nytimes.com/2007/12/13/can-things-get-worse/index.html?hp

Norris is good on this topic.

Where Have You Gone Joe Dimaggio?

July 16, 2007

The Detailed Life of DiMaggio, Minus Juicy Details

By RICHARD SANDOMIR

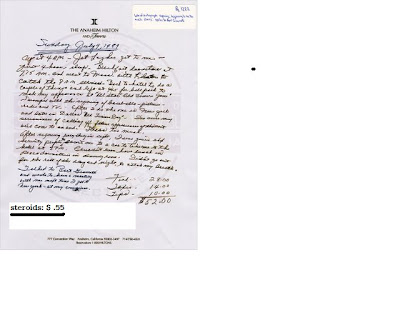

Joe DiMaggio kept a diary. Think of that for a moment.

The private DiMaggio — who spurned millions of dollars to write a tell-all autobiography but not the riches derived from signing bats or balls — dedicated parts of many days from 1982 to 1993 to recording his activities in a flowing script. You can almost imagine him at day’s end, maybe with his tie still knotted but his blazer hanging in the closet, summarizing his day.

It is not a juicy personal journal. Meals with pals, not his romances, were cited as he moved from his late 60s to his late 70s. A sampling of the entries showed pages filled with mundane details and occasionally interesting detours. They were set down on hotel and airline stationery, plain white or yellow legal paper, but never on personal letterhead. He ended entries as if submitting them for reimbursement: by itemizing his expenses.

“He’d bring them into my office, hand them to the office manager every month and say, ‘Tell Morris there’s good stuff in here for his book,’ ” said Morris Engelberg, DiMaggio’s lawyer. He added: “These writings really show who he is. He’s just a plain old Joe.”

Engelberg recently sold the collection of nearly 2,500 pages preserved in 29 binders to Steiner Sports. At a news conference today at Gallagher’s Steak House, one of DiMaggio’s favorites in New York, Steiner is expected to announce its plans to auction the trove in its entirety or page by page.

“We’re listing it at a minimum $1.5 million bid,” said Brandon Steiner, the chairman of the company. “To get a whole page of a guy’s handwritten notes, you have to believe each page is worth $2,000 to $5,500 each.”

What Steiner eventually gets is almost tangential to the almost voyeuristic look at the particulars of DiMaggio’s life.

He wrote down when he woke up, flight numbers and boarding times.

If he took a steam bath, he took note.

On Dec. 12, 1983, he visited his accountant. “Mr. Coffee made me an offer and we discussed at length what my counter bid should be,” he wrote.

There were breakfasts at the Stage Deli in Manhattan with pals.

Lunch with Mayor Edward I. Koch at the Waldorf-Astoria Hotel.

The dedication of a baseball field at the Virginia Military Institute.

He described a day in April 1986 when he made appearances in Rego Park, Queens, and Manhattan for the Bowery Bank. “Went to lobby — signed pics — autographs and conversed with customers,” he wrote.

At the conclusion of his unemotional recollection about receiving the Medal of Honor from the Liberty-Ellis Island Foundation on Oct. 27, 1986, he added: “Missed the last game of World Series. Back to Hasbrouck Heights hotel at 10 p.m. Saw the end of baseball on T.V.”

There is nothing about Marilyn Monroe.

DiMaggio was at the White House on Dec. 8, 1987, for the signing of the treaty banning intermediate missiles by President Ronald Reagan and the Soviet leader Mikhail Gorbachev. DiMaggio wrote that he was up at 6:30 a.m. and arrived at the East Gate in a limousine driven by a man named Leroy.

“An historic time,” DiMaggio wrote. Then: “Left White House lawn at 11:15 a.m. Went out and shopped for a tuxedo shirt as I have lost so much weight my neck size is 15 ½. Spent a couple of hours trying to find one.”

Later, on stationery from The Jefferson, a hotel in Washington, he recorded that he was one of 130 guests at a state dinner, flanked at the “number 10 table” by Maureen Reagan, the president’s older daughter, and Helena Shultz, the wife of Secretary of State George P. Shultz. “Had a good dinner and conversation with both ladies,” he said. Then, after dinner, the guests listened to Van Cliburn play piano. “Mrs. Gorbachev requested a song and Mr. Gorbachev sang some of the words from his chair,” he wrote.

DiMaggio was back in his hotel room by 11:30 that night, and on the second sheet of his entry, he wrote, “Food, tips, taxis, etc. $70.00.”

The entries illustrate DiMaggio’s frustrations with fans and current and former major leaguers who wanted his autograph.

From Anaheim, Calif., on July 8, 1989, he wrote: “Swamped with the signing of baseballs — pictures — radio and TV. Stress too much.”

Six days later, he described the “zoo” at Old-Timers’ Day at Yankee Stadium: “Must have signed at least three hundred for Old Timers — present-day players and everybody that was in the clubhouse — and it was packed.” Then: “It no longer is that people want one ball signed. All have two, three or four. Even Sparky Anderson sent a dozen over for me to sign.”

On April 30, 1991, he wanted to relax at Kennedy Airport before a flight to Miami, but he wrote: “I was asked for another autograph — just one interruption after another — people must think I have skin like an armored plate. Will get a checkup and find out how I’m holding up.”

He chafed at the benefits piling up early in 1991 to honor the 50th anniversary of his 56-game hitting streak. “If I thought this would be taking place due to the streak,” he wrote on Jan. 14 with sarcasm (or was it disdain?), “I would have stopped hitting at 40 games.”

Expenses: $46.

http://www.nytimes.com/imagepages/2007/07/16/sports/16dimaggio_CA0.ready.html

Krugman Today in NYT

Paul Krugman today says it best. No wonder a weakling is the only one who will take the helm at Citicorp. No wonder Citicorp is Goldman Sach's "Short of the Year" for 2008.

When my family flew into Moscow to tour with Genevieve, right after the wall came down, my first thought was: How fortunate Russia will be: none of their private property is mortgaged. ALL of the U.S. is mortgaged. What potential Russia has!

December 14, 2007

Op-Ed Columnist

After the Money’s Gone

By PAUL KRUGMAN

On Wednesday, the Federal Reserve announced plans to lend $40 billion to banks. By my count, it’s the fourth high-profile attempt to rescue the financial system since things started falling apart about five months ago. Maybe this one will do the trick, but I wouldn’t count on it.

In past financial crises — the stock market crash of 1987, the aftermath of Russia’s default in 1998 — the Fed has been able to wave its magic wand and make market turmoil disappear. But this time the magic isn’t working.

Why not? Because the problem with the markets isn’t just a lack of liquidity — there’s also a fundamental problem of solvency.

Let me explain the difference with a hypothetical example.

Suppose that there’s a nasty rumor about the First Bank of Pottersville: people say that the bank made a huge loan to the president’s brother-in-law, who squandered the money on a failed business venture.

Even if the rumor is false, it can break the bank. If everyone, believing that the bank is about to go bust, demands their money out at the same time, the bank would have to raise cash by selling off assets at fire-sale prices — and it may indeed go bust even though it didn’t really make that bum loan.

And because loss of confidence can be a self-fulfilling prophecy, even depositors who don’t believe the rumor would join in the bank run, trying to get their money out while they can.

But the Fed can come to the rescue. If the rumor is false, the bank has enough assets to cover its debts; all it lacks is liquidity — the ability to raise cash on short notice. And the Fed can solve that problem by giving the bank a temporary loan, tiding it over until things calm down.

Matters are very different, however, if the rumor is true: the bank really did make a big bad loan. Then the problem isn’t how to restore confidence; it’s how to deal with the fact that the bank is really, truly insolvent, that is, busted.

My story about a basically sound bank beset by a crisis of confidence, which can be rescued with a temporary loan from the Fed, is more or less what happened to the financial system as a whole in 1998. Russia’s default led to the collapse of the giant hedge fund Long Term Capital Management, and for a few weeks there was panic in the markets.

But when all was said and done, not that much money had been lost; a temporary expansion of credit by the Fed gave everyone time to regain their nerve, and the crisis soon passed.

In August, the Fed tried again to do what it did in 1998, and at first it seemed to work. But then the crisis of confidence came back, worse than ever. And the reason is that this time the financial system — both banks and, probably even more important, nonbank financial institutions — made a lot of loans that are likely to go very, very bad.

It’s easy to get lost in the details of subprime mortgages, resets, collateralized debt obligations, and so on. But there are two important facts that may give you a sense of just how big the problem is.

First, we had an enormous housing bubble in the middle of this decade. To restore a historically normal ratio of housing prices to rents or incomes, average home prices would have to fall about 30 percent from their current levels.

Second, there was a tremendous amount of borrowing into the bubble, as new home buyers purchased houses with little or no money down, and as people who already owned houses refinanced their mortgages as a way of converting rising home prices into cash.

As home prices come back down to earth, many of these borrowers will find themselves with negative equity — owing more than their houses are worth. Negative equity, in turn, often leads to foreclosures and big losses for lenders.

And the numbers are huge. The financial blog Calculated Risk, using data from First American CoreLogic, estimates that if home prices fall 20 percent there will be 13.7 million homeowners with negative equity. If prices fall 30 percent, that number would rise to more than 20 million.

That translates into a lot of losses, and explains why liquidity has dried up. What’s going on in the markets isn’t an irrational panic. It’s a wholly rational panic, because there’s a lot of bad debt out there, and you don’t know how much of that bad debt is held by the guy who wants to borrow your money.

How will it all end? Markets won’t start functioning normally until investors are reasonably sure that they know where the bodies — I mean, the bad debts — are buried. And that probably won’t happen until house prices have finished falling and financial institutions have come clean about all their losses. All of this will probably take years.

Meanwhile, anyone who expects the Fed or anyone else to come up with a plan that makes this financial crisis just go away will be sorely disappointed.

Monday, December 10, 2007

On Herb Greenberg's Blog

and referred to today, Monday, December 10, 2007, on CNBC.

12:11:23 PM December 6th, 2007

Permalink | Comments (521)

Even before this mortgage mess started, one person who kept emailing me over and over saying that this is going to get real bad. He kept saying this was beyond sub-prime, beyond low FICO scores, beyond Alt-A and beyond the imagination of most pundits, politicians and the press. When I asked him why somebody from inside the industry would be so emphatically sounding the siren, he said, “Someobody’s got to warn people.”

Since then, I’ve kept up an active dialog with Mark Hanson, a 20-year veteran of the mortgage industry, who has spent most of his career in the wholesale and correspondent residential arena — primarily on the West Coast. He lives in the Bay Area. So far he has been pretty much on target as the situation has unfolded. I should point out that, based on his knowledge of the industry, he has been short a number of mortgage-related stocks.

His current thoughts, which I urge you to read:

The Government and the market are trying to boil this down to a ’sub-prime’ thing, especially with all constant talk of ‘resets’. But sub-prime loans were only a small piece of the mortgage mess. And sub-prime loans are not the only ones with resets. What we are experiencing should be called ‘The Mortgage Meltdown’ because many different exotic loan types are imploding currently belonging to what lenders considered ‘qualified’ or ‘prime’ borrowers. This will continue to worsen over the next few of years. When ‘prime’ loans begin to explode to a degree large enough to catch national attention, the ratings agencies will jump on board and we will have ‘Round 2′. It is not that far away.

Since 2003, when lending first started becoming extremely lax, a small percentage of the loans were true sub-prime fixed or arms. But sub-prime is what is being focused upon to draw attention away from the fact the lenders and Wall Street banks made all loans too easy to attain for everyone. They can explain away the reason sub-prime loans are imploding due to the weakness of the borrower.

How will they explain foreclosures in wealthy cities across the nation involving borrowers with 750 scores when their loan adjusts higher or terms change overnight because they reached their maximum negative potential on a neg-am Pay Option ARM for instance?

Sub-prime aren’t the only kind of loans imploding. Second mortgages, hybrid intermediate-term ARMS, and the soon-to-be infamous Pay Option ARM are also feeling substantial pressure. The latter three loan types mostly were considered ‘prime’ so they are being overlooked, but will haunt the financial markets for years to come. Versions of these loans were made available to sub-prime borrowers of course, but the vast majority were considered ‘prime’ or Alt-A. The caveat is that the differentiation between Prime and ALT-A got smaller and smaller over the years until finally in late 2005/2006 there was virtually no difference in program type or rate.

The bailout we are hearing about for sub-prime borrowers will be the first of many. Sub-prime only represents about 25% of the problem loans out there. What about the second mortgages sitting behind the sub-prime first, for instance? Most have seconds. Why aren’t they bailing those out too? Those rates have risen dramatically over the past few years as the Prime jumped from 4% to 8.25% recently. seconds are primarily based upon the prime rate. One can argue that many sub-prime first mortgages on their own were not a problem for the borrowers but the added burden of the second put on the property many times after-the-fact was too much for the borrower.

Most sub-prime loans in existence are refinances not purchase-money loans. This means that more than likely they pulled cash out of their home, bought things and are now going under. Perhaps the loan they hold now is their third or forth in the past couple years. Why are bad borrowers, who cannot stop going to the home-ATM getting bailed out?

The Government says they are going to use the credit score as one of the determining factors. But we have learned over the past year that credit scores are not a good predictor of future ability to repay. This is because over the past five years you could refi your way into a great score. Every time you were going broke and did not have money to pay bills, you pulled cash out of your home by refinancing your first mortgage or upping your second. You pay all your bills, buy some new clothes, take a vacation and your score goes up!

The ’second mortgage implosion’, ‘Pay-Option implosion’ and ‘Hybrid Intermediate-term ARM implosion’ are all happening simultaneously and about to heat up drastically. Second mortgage liens were done by nearly every large bank in the nation and really heated up in 2005, as first mortgage rates started rising and nobody could benefit from refinancing. This was a way to keep the mortgage money flowing. Second mortgages to 100% of the homes value with no income or asset documentation were among the best sellers at CITI, Wells, WAMU, Chase, National City and Countrywide. We now know these are worthless especially since values have indeed dropped and those who maxed out their liens with a 100% purchase or refi of a second now owe much more than their property is worth.

How are the banks going to get this junk second mortgage paper off their books? Moody’s is expecting a 15% default rate among ‘prime’ second mortgages. Just think the default rate in lower quality such as sub-prime. These assets will need to be sold for pennies on the dollar to free up capacity for new vintage paper or borrowers allowed to pay 50 cents on the dollar, for instance, to buy back their note.

The latter is probably where the ’second mortgage implosion’ will end up going. Why sell the loan for 10 cents on the dollar when you can get 25 to 50 cents from the borrower and lower their total outstanding liens on the property at the same time, getting them ‘right’ in the home again? Wells Fargo recently said they owned $84 billion of this worthless paper. That is a lot of seconds at an average of $100,000 a piece. Already, many lenders are locking up the second lines of credit and not allowing borrowers to pull the remaining open available credit to stop the bleeding. Second mortgages are defaulting at an amazing pace and it is picking up every month.

The ‘Pay-Option ARM implosion’ will carry on for a couple of years. In my opinion, this implosion will dwarf the ’sub-prime implosion’ because it cuts across all borrower types and all home values. Some of the most affluent areas in California contain the most Option ARMs due to the ability to buy a $1 million home with payments of a few thousand dollars per month. Wamu, Countrywide, Wachovia, IndyMac, Downey and Bear Stearns were/are among the largest Option ARM lenders. Option ARMs are literally worthless with no bids found for many months for these assets. These assets are almost guaranteed to blow up. 75% of Option ARM borrowers make the minimum monthly payment. Eighty percent-plus are stated income/asset. Average combined loan-to-value are at or above 90%. The majority done in the past few years have second mortgages behind them.

The clue to who will blow up first is each lenders ‘max neg potential’ allowance, which differs. The higher the allowance, the longer until the borrower gets the letter saying ‘you have reached your 110%, 115%, 125% etc maximum negative of your original loans balance so you cannot accrue any more negative and must pay a minimum of the interest only (or fully indexed payment in some cases). This payment rate could be as much as three times greater. They cannot refinance, of course, because the programs do not exist any longer to any great degree, the borrowers cannot qualify for other more conventional financing or values have dropped too much.

Also, the vast majority have second mortgages behind them putting them in a seriously upside down position in their home. If the first mortgage is at 115%, the second mortgage in many cases is at 100% at the time of origination — and values have dropped 10%-15% in states like California — many home owners could be upside down 20% minimum. This is a prime example of why these loans remain ‘no bid’ and will never have a bid. These also will require a workout. The big difference between these and sub-prime loans is at least with sub-prime loans, outstanding principal balances do not grow at a rate of up to 7% per year. Not considering every Option ARM a sub-prime loan is a mistake.

The 3/1, 5/1, 7/1 and 10/1 hybrid interest-only ARMS will reset in droves beginning now. These are loans that are fixed at a low introductory interest only rate for three, five, seven or 10 years — then turn into a fully indexed payment rate that adjusts annually thereafter. They first got really popular in 2003. Wells Fargo led the pack in these but many people have them. The resets first began with the 3/1 last year.

The 5/1 was the most popular by far, so those start to reset heavily in 2008. These were considered ‘prime’ but Wells and many others would do 95%-100% to $1 million at a 620 score with nearly as low of a rate as if you had a 750 score. No income or asset versions of this loan were available at a negligible bump in fee. This does not sound too ‘prime’ to me. These loans were mostly Jumbo in higher priced states such as California.

Values are down and these are interest only loans, therefore, many are severely underwater even without negative-amortization on this loan type. They were qualified at a 50% debt-to-income ratio, leaving only 50% of a borrower’s income to pay taxes, all other bills and live their lives. These loans put the borrower in the grave the day they signed their loan docs especially without major appreciation. These loans will not perform as poorly overall as sub-prime, seconds or Option ARMs but they are a perfect example of what is still considered ‘prime’ that is at risk. Eighty-eight percent of Thornburg’s portfolio is this very loan type for example.

One final thought. How can any of this get repaired unless home values stabilize? And how will that happen? In Northern California, a household income of $90,000 per year could legitimately pay the minimum monthly payment on an Option ARM on a million home for the past several years. Most Option ARMs allowed zero to 5% down. Therefore, given the average income of the Bay Area, most families could buy that million dollar home. A home seller had a vast pool of available buyers.

Now, with all the exotic programs gone, a household income of $175,000 is needed to buy that same home, which is about 10% of the Bay Area households. And, inventories are up 500%. So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes. To get housing moving again in Northern California, either all the exotic programs must come back, everyone must get a 100% raise or home prices have to fall 50%. None, except the last sound remotely possible.

What I am telling you is not speculation. I sold BILLIONs of these very loans over the past five years. I saw the borrowers we considered ‘prime’. I always wondered ‘what WILL happen when these things adjust is values don’t go up 10% per year’.

Now we’re finding out. If you made it all the way to the bottom, you can see why I decided to run this. Feel free to post thoughts below. Mark will likely be personally responding to any comments.

Sunday, December 9, 2007

Paulson's Plan

The following editorial in the NYT today expresses my feelings. When GWB took center stage my heart sank. That meant that industry was driving this plan.

--------------------------------------------------------------------------------

December 9, 2007

Editorial

Show Us the Mortgage Relief

When he announced a new plan to try to stanch the foreclosure crisis, Treasury Secretary Henry Paulson Jr. said that the officials, lenders and investors involved had been working toward it since August. That start date is a useful benchmark for measuring the plan’s inadequacy.

Only an estimated 250,000 borrowers, at best, are likely to benefit from the plan’s main relief measure — a five-year freeze on certain adjustable loans’ introductory rates. Yet, from mid-2007 to now, some 800,000 homeowners have entered foreclosure. From 2008 through mid-2010, when the last of the potentially eligible loans would otherwise reset to sharply higher payments, there will be an estimated 3.5 million loan defaults.

The plan is too little, too late and too voluntary. Mr. Paulson and his boss, President Bush, have left it to the private sector — the mortgage industry — to protect the public interest, without any negative consequences if it does not. That is not the way the private sector works. And it is not how government is supposed to work at a time when Americans are facing mass foreclosures that threaten entire communities, financial markets and the wider economy.

Many mortgage servicers — lenders and private companies that collect mortgage payments on behalf of investors — have been reluctant to modify at-risk loans, even though the alternative is to foreclose on thousands of homeowners. That is because they fear being sued by mortgage investors. For some investors, letting a troubled borrower default would actually be better business, for others not. It all depends on how their particular security is set to pay out.

The new plan establishes guidelines that lenders can use to determine which troubled borrowers might qualify for a rate freeze. But even lenders that stick to the government-brokered guidelines have no guarantee that they cannot be sued.

The criteria for who gets relief and who does not are also a problem. Some are reasonable: borrowers must live in their homes and have a good repayment record on their mortgage loan. Others are far too restrictive: borrowers can be disqualified if they have improved their credit score during the loan’s introductory period, a move that is intended to weed out anyone with even the smallest probability of being able to afford a payment that is set to explode, but which could subject homeowners who need help to delays and denials.

Investors may simply be too self-interested to pull off the aggressive, broad-based loan fixes that Mr. Paulson has said he wants — and that the nation needs. Rather than standing up to Wall Street, Mr. Paulson is hoping that the interests of investors — to make money — will magically align with the interests of homeowners, to keep a roof over their heads.

Mr. Paulson should be prepared to choose sides. If the voluntary efforts are not much more successful than expected — and soon — he should support the tougher approaches being called for on Capitol Hill. One bill would help shield lenders who modify loans from being sued by investors. Another would allow troubled borrowers to restructure their mortgages under bankruptcy court protection. Both would give the industry a strong motivation to ramp up loan modifications — or watch the courts take over. If the industry drags its feet, that is exactly what should happen.

Saturday, December 8, 2007

Duke Bill November Usage Laurel

Cramer Yesterday

Cramer says cut from fully-invested to 75% invested, based on S&P oscillator, which is the only oscillator he trusts. Or if you can go short, go short 25%. It (oscillator) didn’t work in 1987 but about 500 other times it has worked. It’s a proprietary oscillator.

Peace in Nigeria. Iraq is “stable;” Iran is off the table. Talks about Statoil. Remains bullish on oil. They have to drill deeper in North Sea. Mexico not replentishing. For every North Sea…Transocean Deal…Not enough rigs. Very capital intensive industry. Can’t turn a switch.

Friday, December 7, 2007

Normal Heating Degree Days for December 7

are 28.

So the normal cost for natural gas for one house is 9 x $1.20, or $10.80.

3000 sq. ft victorian house

Avg. temp in fact today = 37 degrees, or 27 degree days. Almost exactly normal. (65 degrees minus 37 = 28)

Saving Money on Heating Your House

The following from the Cincinnati Enquirer is worthwhile:

http://news.enquirer.com/apps/pbcs.dll/article?AID=/20071202/CINCI/312060044

Click on Title above or cut and paste the above.

Thursday, December 6, 2007

Duke Bill November Usage -- Greenville

From the Dallas News Yesterday

New developments in a somewhat old story, but still...

Prosecutors say traders tried to manipulate natural gas prices

12/05/2007

By JUAN A. LOZANO / Associated Press

Three former El Paso Corp. traders' efforts to manipulate the price of natural gas by reporting false data were driven by greed, prosecutors told jurors Wednesday.

But defense attorneys for James Brooks, Wesley C. Walton and James Patrick Phillips told jurors the ex-traders never submitted false data and were victims of unclear policies on how to report pricing information.

Each defendant is on trial for 49 counts of conspiracy, false reporting and wire fraud related to accusations of reporting bogus trade data used to calculate natural gas index prices. If convicted, each faces up to five years in prison and a fine up to $500,000 for each count.

Natural gas price indexes are used to price billions of dollars in transactions involving natural gas and electricity in physical and financial markets each year. El Paso owns the largest network of natural gas pipelines in the country.

Prosecutor John Lewis told jurors during opening statements that the trio from 2000 to 2002 transmitted 81 reports containing false data to Inside FERC Natural Gas Report and Natural Gas Intelligence, two industry journals.

The journals conduct pricing surveys of natural gas bought and sold in the country by polling traders. The three ex-traders submitted false data to the journals in order to drive up or down the daily price of natural gas, Lewis said.

They reported the bogus trade data in order to earn more profits for their company and as a result get paid bigger work bonuses, he said.

"You can see the potential for abuse and abused this system was," Lewis said.

Brooks, who was El Paso's former head of natural gas trading, was the person most responsible for fraud at the company, Lewis said.

"He ordered (employees) to do it even when employees objected," he said. "Brooks ordered fraud to take place. Walton guided it. Phillips carried it out."

Wendell Odom, Brooks' attorney, told jurors that while his client was a "hard-driving" trader, he didn't submit false data.

"All of the (false) reporting we are accused of doing is going to be within the range of what people actually purchased and sold natural gas for," he said.

Odom denied Brooks or the others earned big bonuses for their work.

"He's a good man," Odom said.

Lewis told jurors that prosecutors would play recordings of business calls in which all three defendants talked and bragged about manipulating prices.

David Gerger, Walton's attorney, said prosecutors are taking the calls out of context.

"They are cursing like a sailor, boasting, bragging," he said. "That horrible language that traders talk is not a crime. What he's accused of, the evidence will show you he didn't do."

David Adler, Phillips' attorney, told jurors his client is a hardworking family man who never got instructions from his company or the trade journals on how to report the natural gas data.

"The information he sent was from actual trades. It's not fake information," Adler said. "Others may have sent fake numbers."

Lewis said the ex-traders' actions had real-world consequences because public utilities paid for natural gas based on the price indexes, thus affecting the cost for consumers.

Under federal law, the government needs to prove only that fake trades were reported — not whether they were published or affected the markets.

The charges against the three were part of investigations conducted by the federal government's Corporate Fraud Task Force. Since December 2002, the group has filed charges around the country related to the manipulation of energy markets against 38 companies and 26 individuals and has obtained nearly $435 million in fines.

Seven former El Paso traders have either been convicted or have pleaded guilty to charges related to making fake trades. Many of these ex-traders are expected to testify during the trial, which could last up to six weeks.

Houston-based El Paso paid the Commodity Futures Trading Commission $20 million in 2003 to settle fake trade allegations

Cramer Says

If Cramer is right in his comments we are over the crisis because all leaders agree to do whatever is necessary to overcome the crisis. Certainly Paulson has the smarts. But does he have the guts? He does if Bush has the guts. Hey, wait. Bush isn't running again. He doesn't have to have the guts.

So it's a no-brainer. Even the bad guys -- see today's NYT blogged just below -- cannot stand up anymore.

Sanctity of contract? Forget it. But it's in the Constitution! Forget it. But I'm short! Forget it.

(Since I'm not short, but I do carry two houses; I want the help that will come to the real estate market from what is promised.)

There is, however, the possibility that the "plan" will be like the Part D Medicare prescription fiasco -- much ado helping few.

Easy Reference to Michael Lewis' "Liar's Poker"

“The trading floor is a jungle and the guy you end up working

for is the jungle leader; whether you succeed here or not depends on knowing how to survive in the

jungle,” said one of the leading bond salesman. Some of the other lessons Lewis learned during the training were:

• The market always has a fool. If you can’t see one, it’s probably you.

• You work for Salomon, not the customer, so blowing up the customer is understandable.

• You don’t get ahead by being nice, you get ahead by making money

Tuesday, December 4, 2007

Richard D. Cudahy

As readers of this Blog know, Richard D. Cudahy is one of the great judges of our country. In the two fields of my changing practice he has written definitive articles which were ahead of their time and/or which changed the law exactly as needed -- in my Sixth Circuit. (Asmo case being the latter). Click on my label "Judge Cudahy" for the details.

Here's another paper I came across this morning.

From Insull to Enron: Corporate (Re)Regulation After the Rise and Fall of Two Energy Icons

HON. RICHARD D. CUDAHY

U.S. Court of Appeals for the 7th Circuit

WILLIAM D. HENDERSON

Indiana University School of Law-Bloomington

--------------------------------------------------------------------------------

Energy Law Journal, Vol. 25, No. 1, pp. 35-110, 2005

Abstract:

For most Americans, the collapse of the Enron Corporation is without doubt the most memorable corporate event of their generation. Remarkably, few people are aware that the New Deal regulatory framework - which Congress recently reformed and toughened to in response to the Enron debacle - was itself erected in the wake of a strikingly similar corporate crash. In late 1931 and early 1932, the country looked on in horror as Samuel Insull's mighty and seemingly invulnerable electric utility holding company empire collapsed without warning, wiping out the holdings of over 1 million investors, most of whom believed that they had invested in a safe and secure electric utility enterprise. The newspapers of the day declared the event "the biggest business failure in the history of the world." President Franklin D. Roosevelt and the progressives in Congress subsequently used the Insull debacle as a rallying point from which to promote many of the most important laws of the New Deal, including the Securities Act of 1933, the Securities Exchange Act of 1934, the Public Utility Holding Company Act of 1935, the Federal Power Act of 1935, and the legislation creating the Tennessee Valley Authority and the Rural Electrification Administration.

This Article chronicles the striking similarities, and the ironic differences, between the respective failures of Insull and Enron. A careful examination of these historic events suggests that Insull and Enron were emblematic of rare moments in history when the birth of an infrastructure industry generates an enormous surge in economic activity, capturing the imagination of the investing public and weakening the commitment of the political class to serve, if needed, as vigilant, disinterested regulators.

The main lesson that emerges from our analysis is not so much that we need to strengthen laws against corporate wrongdoing. Rather, it is in recognizing that, during a financial bubble driven by rapid growth in network industries (e.g., electricity and the Internet), regulatory officials will almost inevitably buckle under political pressure and (a) fail to issue new rules that might interfere with the financial "hijinks" and (b) fail to enforce vigorously laws already on the books. This Article suggests that the laws adopted in response to Enron are destined to be watered down and ignored during the next boom, just as the New Deal laws, passed in response to the Insull debacle, were watered down and ignored during the 1990s. The authors reluctantly conclude that history will likely repeat itself in another generation or two, and there is little that can be done beyond vain entreaties to our own grandchildren to become more devoted students of history.

Keywords: Enron, Insull, electricity, deregulation, New Deal, securities, SEC, FERC, PUHCA, PURPA, Energy Policy Act of 1992

JEL Classifications: B15, B25, B31, G18, G38, K22, K23, L51, L94

Accepted Paper Series

--------------------------------------------------------------------------------

Suggested Citation

Cudahy, Hon. Richard D. and Henderson, William D. , "From Insull to Enron: Corporate (Re)Regulation After the Rise and Fall of Two Energy Icons" (March 2005). Energy Law Journal, Vol. 25, No. 1, pp. 35-110, 2005 Available at SSRN: http://ssrn.com/abstract=716321

Cramer and Seth Tobias, etc.

I remember seeing Seth Tobias on CNBC a few times. I've put many different labels on this article because its cultural aspects touch on so many, including "Hunter S. Thompson," even "Clarence Thomas." It raises the question, a variation of which used to be on the nightly news here in Cincinnati, "It's Eleven O'clock. What is your Trust officer doing?"

December 4, 2007

A Lurid Aftermath to a Hedge Fund Manager’s Fast Life

By ANDREW ROSS SORKIN

JUPITER, Fla. — A life of private jets and black-tie balls ended with Seth Tobias, a wealthy investment manager and a familiar presence on CNBC, floating face down in the swimming pool of his mansion here.

It was just after midnight on Sept. 4 when Mr. Tobias’s wife, Filomena, frantically called 911. “Please send somebody, please!” Mrs. Tobias screamed. “He’s not breathing!” By the time the police arrived, she had pulled her husband’s body to the edge of the pool, where she cradled his head in her arms, sobbing.

Mr. Tobias, who was 44 years old, had apparently suffered a heart attack, his brother Spence said at the time. The police did not consider his death suspicious.

But now an unfolding drama over Mr. Tobias’s estate is providing a lurid account of fast money and faster living in the volatile world of hedge funds. Mr. Tobias’s four brothers and Mrs. Tobias are locked in a legal battle over the estate, which is worth at least $25 million. And, in a civil complaint, they have gone so far as to accuse her of murder.

The brothers, Samuel, Spence, Scott and Joshua, claim Mrs. Tobias drugged her husband and lured him into the pool. Bill Ash, a former assistant to Mr. Tobias, said he had told the police that Mrs. Tobias confessed to him that she had cajoled her husband into the water while he was on a cocaine binge with a promise of sex with a male go-go dancer known as Tiger.

Mrs. Tobias’s lawyers call the claims outrageous. She has not been accused of any crime.

The mystery deepened when it emerged that Mrs. Tobias spent $9,628 to have the pool drained and resurfaced days after her husband died, according to documents filed in an unrelated case.

The salacious accusations have captivated this wealthy enclave north of West Palm Beach and transfixed the investment world in New York, where Mr. Tobias ran a $300 million hedge fund from an office on Park Avenue. From the Breakers hotel in Palm Beach, a stately symbol of old money, to trading floors on Wall Street, the epicenter of the explosive wealth now reshaping American society, the case is seen as a parable of the modern gilded age.

“I don’t understand why this hasn’t ended up on ‘CSI: Miami’ yet,” said Jim Cramer, the host of CNBC’s stock-picking show “Mad Money” and Mr. Tobias’s former boss on Wall Street.

The questions keep piling up, starting with the big one: How did Mr. Tobias die? The police in Jupiter have not opened a homicide investigation but are awaiting the results of toxicology tests before making a final determination, said Sgt. Scott Pascarella.

At the center of the dispute is Mr. Tobias’s will, which designates his brothers as beneficiaries but does not name Mrs. Tobias. She contends that she is entitled to the estate because the will was signed before the couple married. In court filings, the Tobias brothers invoke Florida’s “slayer statute,” which prohibits inheritance by a person who murders someone from whom they stand to inherit. They claim she “intentionally killed” her husband “by asphyxiation and drowning.”

One lawyer representing Mrs. Tobias, Gary Dunkin, said he was shocked by the accusation. “In my 25 years practicing law, this is the most reckless allegation I have ever seen,” he said in court. Her lawyers, which include her prior husband, Jay J. Jacknin, have asked the court to put off her depositions, citing her “psychiatric condition.” They said she hired contractors to empty the pool because she was distraught over her husband’s death.

However this mystery plays out, it is providing a treasure of details about the lavish lifestyles that hedge funds can afford their founders, and perhaps sheds light on how all that money ultimately influences personal lives.

Mr. Tobias, a native of Philadelphia, entered this secretive, often volatile corner of the financial world after spending less than a decade on Wall Street, including a stint with Mr. Cramer’s former money-management firm. He formed Circle T in 1996, with $4 million, and parlayed that into a $300 million hedge fund and brokerage firm. Circle T is in the process of returning investors’ funds; clients have not lost money.

He counted among his investors Samuel Zell, the billionaire who recently agreed to buy the Tribune Company. Mr. Zell, in an interview, said he rarely interacted with Mr. Tobias. “I knew Seth for 10 or 15 years on a very unconnected basis,” he said. “He was a good, smart guy.”

Along the way, Mr. Tobias collected the trappings of success. He spent days at the Kentucky Derby and nights at Donald Trump’s Mar-a-Lago Club. He frequently shuttled by private jet between New York, where he worked in the Seagram Building in Manhattan, and Florida, where he owned two homes.

Mr. Tobias made — and apparently spent — millions of dollars a year, court documents suggest. Outstanding expenses at the time of his death included $52,532 on his American Express Centurion Black Card and $7,960 on his Bank of America credit card. His mortgage payment for one of his homes was $35,000 a month. He paid $1,367 a month to lease a Land Rover. His monthly cable bill from Comcast was $535.19.

But the boyish Mr. Tobias never ran with the titans of Wall Street. He was a small player in an industry where successful managers command billions or even tens of billions of dollars. Nonetheless, Mr. Tobias managed to make a name for himself on financial-news television, appearing on “Squawk Box” and “Kudlow & Company” on CNBC.

Now, the hints emerging about his private life have captivated Wall Street. Mrs. Tobias told the police that her husband may have been using cocaine on the night he died, according to police reports. Some of Mr. Tobias’s former associates say he used drugs regularly and often disappeared from his office for days or weeks at a time.

Mr. Tobias’s life was apparently as volatile as his investment returns. After Circle T lost 5.3 percent in 2005, his marriage began to fray. In March 2006, the police were called to the Tobiases’ home because of a domestic disturbance. A few days later. Mr. Tobias filed for divorce. It was one week before the couple’s first anniversary.

The Tobiases later reconciled. But the divorce filings included a laundry list of accusations. Mrs. Tobias stated that she caught him having an “adulterous affair” and that he “gambled away tens of thousands of dollars and used other funds on illicit habits.” She asked the court to award her $46,000 a month for living expenses. He argued that she was constantly spending too much money.

Even after the couple reconciled, they fought constantly, mostly over money, according to several friends, who asked not to be identified for fear of being subpoenaed in connection with the case or because they were worried that their professional reputations would be harmed by being associated with the case. At one point, Mrs. Tobias bought a Porsche on her credit card and then cried when Mr. Tobias told her to return it, one friend recounted.

They also secretly frequented a gay bar called Cupids in West Palm Beach, in a strip mall along a main thoroughfare. It was there, according to Mr. Ash, that Mr. Tobias first met Tiger.

“Seth used to come in here back when it was crazy,” said Adiel Hemingway, the longtime manager of Cupids. As a flat-screen television blared hard-core gay pornography, he said that Mr. Tobias often came to the club with his wife. Mr. Hemingway took out a picture of Tiger in his office. Tiger is blond and covered with tattoos that look like stripes.

“I know exactly who he is, but I’m not telling you,” Mr. Hemingway said. The Tobias brothers have subpoenaed Tiger, using the address of Cupids, but have been unable to learn his true name.

The day Mr. Tobias died, he spent the afternoon at the Breakers with his wife and several friends, drinking and possibly using cocaine, according to Mrs. Tobias’s statement to the police. From there, Mr. Tobias went with one of the friends to E. R. Bradley’s Saloon, a boisterous open-air bar in Palm Beach that looks over the Intracoastal Waterway.

What happened next is unclear, except that Mr. Tobias was dead in the pool, with abrasions on his nose, forehead and back. When the police arrived, Mrs. Tobias, on the advice of a friend who is a lawyer, refused to let them enter the house, which is perched on the edge of the sixth hole of a Jack Nicklaus-designed golf course in a gated community. After returning with a warrant, the police found a Ziploc bag with a white powdery substance and a small baggie and a straw, as well as two empty plastic prescription bottles. Mr. Tobias’s eyeglasses and a drinking glass were discovered on the bottom of the pool.

According to the brothers’ lawsuit, Mrs. Tobias caused her husband “to ingest one or more controlled substances that induced loss of consciousness and capacity to breathe.” They further claimed that she caused him “to enter the swimming pool at their residence after his ingestion of controlled substances and in his stuporous and helpless condition he was asphyxiated and died.” Mr. Tobias’s best friend, Patrick Bransome, said in a statement to police that he had not seen him go in a pool or swim in years. Mr. Bransome declined to comment.

A few weeks later, Mr. Ash called the police and told them that Mrs. Tobias had confessed to him and that he had a tape recording to prove it. Mr. Ash has a past: he has been arrested at least 11 times on charges ranging from larceny to prostitution; He has been called Mr. Madam because of a past connection he says he had to Heidi Fleiss, the Hollywood Madam. Investigators flew to Mr. Ash’s home in San Diego and spent a day interviewing him.

“She confessed to me on tape,” Mr. Ash, said in an interview. “I believe she absolutely did it.” He would not provide the tape, but expressed outrage that the case was not moving more quickly. “I’m the only one standing up for him. Who else in this whole crazy thing is looking out for him?”

The police in Jupiter appeared unimpressed with Mr. Ash’s allegations. “You can take it for what it is worth,” Sergeant Pascarella said.

Through her lawyers, Mrs. Tobias refused to comment for this article. In a recent interview with The Palm Beach Post, she said, “I’m broken. I haven’t gone out in six weeks. I’ve been in and out of the hospital. I just pray all day and wonder why people could be so evil.”

She said of Mr. Ash: “All those rumors are disgusting. He’s a very sick man who should be institutionalized.”

Jessica Seubert and Jenny Anderson contributed reporting.

Labels:

Clarence Thomas,

Cramer Yesterday,

Hot Air,

Hunter S. Thompson,

Liar's Poker by Michael Lewis

Sunday, December 2, 2007

Subprime Mortgages vs. Casino

Again, from the article quoted in my September 2, 2007 blog.

It was John Maynard Keynes who observed the paradox of securities markets: their very liquidity, which investors perceive as a safeguard, creates the conditions for disaster. “Each individual investor flatters himself that his commitment is ‘liquid,’ ” Keynes wrote, and the belief that he can exit the market at will “calms his nerves and makes him much more willing to run a risk.” The catch is that investors, collectively, can never exit in unison. Whenever they try, panic and losses are the sure result. Once, you had to be a hedge-fund player to experience such a trauma. Now, thanks to the dubious wonders of financial engineering, home buyers are exposed to the very same risks.

More Articles in Magazine »

And Friedman Today

So the best minds are going back into the energy field:

December 2, 2007

Op-Ed Columnist

The People We Have Been Waiting For

By THOMAS L. FRIEDMAN

It was 60 degrees on Thursday in Washington, well above normal, and as I slipped away for some pre-Christmas golf, I found myself thinking about a wickedly funny story that The Onion, the satirical newspaper, ran the other day: “Fall Canceled after 3 Billion Seasons”:

“Fall, the long-running series of shorter days and cooler nights, was canceled earlier this week after nearly 3 billion seasons on Earth, sources reported Tuesday.

“The classic period of the year, which once occupied a coveted slot between summer and winter, will be replaced by new, stifling humidity levels, near-constant sunshine and almost no precipitation for months.

“‘As much as we’d like to see it stay, fall will not be returning for another season,’ National Weather Service president John Hayes announced during a muggy press conference Nov. 6. ‘Fall had a great run, but sadly, times have changed.’ ... The cancellation was not without its share of warning signs. In recent years, fall had been reduced from three months to a meager two-week stint, and its scheduled start time had been pushed back later and later each year.”

You should never extrapolate about global warming from your own weather, but it is becoming hard not to — even for professionals. Consider the final report of the U.N.’s Intergovernmental Panel on Climate Change (I.P.C.C.), which was just issued and got far too little attention. It concluded that since the I.P.C.C. began its study five years ago, scientists had discovered much stronger climate change trends than previously realized, such as far more extensive melting of Arctic ice, and therefore global efforts to reverse the growth of greenhouse gas emissions have to begin immediately.

“What we do in the next two to three years will determine our future,” said the I.P.C.C. chairman, Rajendra Pachauri.

And sweet-sounding “global warming” doesn’t really capture what’s likely to happen. I prefer the term “global weirding,” coined by Hunter Lovins, co-founder of the Rocky Mountain Institute, because the rise in average global temperature is going to lead to all sorts of crazy things — from hotter heat spells and droughts in some places, to colder cold spells and more violent storms, more intense flooding, forest fires and species loss in other places.

While the Bush team came into office brain dead on the climate issue and will leave office with a perfect record of having done nothing significant to mitigate climate change, I’m heartened that our country is increasingly alive on this challenge.

First, Google said last week that it was going to invest millions in developing its own energy business. Google described its goal as “RE < href="http://vds.mit.edu/" target="_">vds.mit.edu is “to identify the key characteristics of events like the race to the moon and then transpose this energy, passion, focus and urgency” on catalyzing a global team to build a clean car. I just love their tag line. It’s what gives me hope:

“We are the people we have been waiting for.”

December 2, 2007

Op-Ed Columnist

The People We Have Been Waiting For

By THOMAS L. FRIEDMAN

It was 60 degrees on Thursday in Washington, well above normal, and as I slipped away for some pre-Christmas golf, I found myself thinking about a wickedly funny story that The Onion, the satirical newspaper, ran the other day: “Fall Canceled after 3 Billion Seasons”:

“Fall, the long-running series of shorter days and cooler nights, was canceled earlier this week after nearly 3 billion seasons on Earth, sources reported Tuesday.

“The classic period of the year, which once occupied a coveted slot between summer and winter, will be replaced by new, stifling humidity levels, near-constant sunshine and almost no precipitation for months.

“‘As much as we’d like to see it stay, fall will not be returning for another season,’ National Weather Service president John Hayes announced during a muggy press conference Nov. 6. ‘Fall had a great run, but sadly, times have changed.’ ... The cancellation was not without its share of warning signs. In recent years, fall had been reduced from three months to a meager two-week stint, and its scheduled start time had been pushed back later and later each year.”

You should never extrapolate about global warming from your own weather, but it is becoming hard not to — even for professionals. Consider the final report of the U.N.’s Intergovernmental Panel on Climate Change (I.P.C.C.), which was just issued and got far too little attention. It concluded that since the I.P.C.C. began its study five years ago, scientists had discovered much stronger climate change trends than previously realized, such as far more extensive melting of Arctic ice, and therefore global efforts to reverse the growth of greenhouse gas emissions have to begin immediately.

“What we do in the next two to three years will determine our future,” said the I.P.C.C. chairman, Rajendra Pachauri.

And sweet-sounding “global warming” doesn’t really capture what’s likely to happen. I prefer the term “global weirding,” coined by Hunter Lovins, co-founder of the Rocky Mountain Institute, because the rise in average global temperature is going to lead to all sorts of crazy things — from hotter heat spells and droughts in some places, to colder cold spells and more violent storms, more intense flooding, forest fires and species loss in other places.

While the Bush team came into office brain dead on the climate issue and will leave office with a perfect record of having done nothing significant to mitigate climate change, I’m heartened that our country is increasingly alive on this challenge.

First, Google said last week that it was going to invest millions in developing its own energy business. Google described its goal as “RE < href="http://vds.mit.edu/" target="_">vds.mit.edu is “to identify the key characteristics of events like the race to the moon and then transpose this energy, passion, focus and urgency” on catalyzing a global team to build a clean car. I just love their tag line. It’s what gives me hope:

“We are the people we have been waiting for.”

Credit Crisis Adds to Gloom in Norway

December 2, 2007

U.S. Credit Crisis Adds to Gloom in Norway

By MARK LANDLER

NARVIK, Norway, Nov. 30 — At this time of year, the sun does not rise at all this far north of the Arctic Circle. But Karen Margrethe Kuvaas says she has not been able to sleep well for days.

What is keeping her awake are the far-reaching ripple effects of the troubled housing market in sunny Florida, California and other parts of the United States.

Ms. Kuvaas is the mayor of Narvik, a remote seaport where the season’s perpetual gloom deepened even further in recent days after news that the town — along with three other Norwegian municipalities — had lost about $64 million, and potentially much more, in complex securities investments that went sour.

“I think about it every minute,” Ms. Kuvaas, 60, said in an interview, her manner polite but harried. “Because of this, we can’t focus on things that matter, like schools or care for the elderly.”

Norway’s unlucky towns are the latest victims — and perhaps the least likely ones so far — of the credit crisis that began last summer in the American subprime mortgage market and has spread to the farthest reaches of the world, causing untold losses and sowing fears about the global economy.

Where all the bad debt ended up remains something of a mystery, but to those hit by the collateral damage, it hardly matters.

Tiny specks on the map, these Norwegian towns are links in a chain of misery that stretches from insolvent homeowners in California to the state treasury of Maine, and from regional banks in Germany to the mightiest names on Wall Street. Citigroup, among the hardest hit, created the investments bought by the towns through a Norwegian broker.

For Ms. Kuvaas, being in such company is no comfort. People here are angry and scared, fearing that the losses will hurt local services like kindergartens, nursing homes and cultural institutions. With Christmas only weeks away, Narvik has already missed a payroll for municipal workers.

Above all, the residents want to know how their close-knit community of 18,000 could have mortgaged its future — built on the revenue from a hydroelectric plant on a nearby fjord — by dabbling in what many view as the black arts of investment bankers in distant places.

“The people in City Hall were naïve and they were manipulated,” said Paal Droenen, who was buying fish at a market across the street from the mayor’s office. “The fund guys were telling them tales, like, ‘This could happen to you.’ It’s a catastrophe for a small town like this.”