Tuesday, December 30, 2008

What Next for the Market?

(c) 2008 F. Bruce Abel

Ok, remember July -- just six months' ago -- when gas prices were untenable? You thought that this cannot, cannot keep up. It didn't. So now, what is it that you feel "cannot, cannot" keep up?

I would choose the topic of existing home prices going down. We all know that continuation of existing home prices going down will doom the bailouts, doom the government, and render the dollar worthless and the world economy will be destroyed as we know it. So, six-months from now existing home prices must be higher and going higher. Everything will be done to bring this about.

Ok, remember July -- just six months' ago -- when gas prices were untenable? You thought that this cannot, cannot keep up. It didn't. So now, what is it that you feel "cannot, cannot" keep up?

I would choose the topic of existing home prices going down. We all know that continuation of existing home prices going down will doom the bailouts, doom the government, and render the dollar worthless and the world economy will be destroyed as we know it. So, six-months from now existing home prices must be higher and going higher. Everything will be done to bring this about.

A Good Settlement Agreement

After completely redacting relevant parts I will be posting a very good settlement agreement contemperaneously entered into this last few days of the year.

Judith Warner I Love You

Why Mom was an alcoholic. We love to look back at domestic desolation of the '50s and even '60s.

http://www.nytimes.com/2008/12/30/opinion/30warner.html

http://www.nytimes.com/2008/12/30/opinion/30warner.html

Herbert -- This Must be Read and Re-Read

Don't just let George Bush slip out of town. Outrage!

http://www.nytimes.com/2008/12/30/opinion/30herbert.html?_r=1

Op-Ed Columnist

Add Up the Damage

comments (141)

new_york_times:http://www.nytimes.com/2008/12/30/opinion/30herbert.html

By BOB HERBERT

Published: December 29, 2008

Does anyone know where George W. Bush is?

Post a Comment »

Read All Comments (141) »

You don’t hear much from him anymore. The last image most of us remember is of the president ducking a pair of size 10s that were hurled at him in Baghdad.

We’re still at war in Iraq and Afghanistan. Israel is thrashing the Palestinians in Gaza. And the U.S. economy is about as vibrant as the 0-16 Detroit Lions.

But hardly a peep have we heard from George, the 43rd.

When Mr. Bush officially takes his leave in three weeks (in reality, he checked out long ago), most Americans will be content to sigh good riddance. I disagree. I don’t think he should be allowed to slip quietly out of town. There should be a great hue and cry — a loud, collective angry howl, demonstrations with signs and bullhorns and fiery speeches — over the damage he’s done to this country.

This is the man who gave us the war in Iraq and Guantánamo and torture and rendition; who turned the Clinton economy and the budget surplus into fool’s gold; who dithered while New Orleans drowned; who trampled our civil liberties at home and ruined our reputation abroad; who let Dick Cheney run hog wild and thought Brownie was doing a heckuva job.

The Bush administration specialized in deceit. How else could you get the public (and a feckless Congress) to go along with an invasion of Iraq as an absolutely essential response to the Sept. 11 attacks, when Iraq had had nothing to do with the Sept. 11 attacks?

Exploiting the public’s understandable fears, Mr. Bush made it sound as if Iraq was about to nuke us: “We cannot wait,” he said, “for the final proof — the smoking gun that could come in the form of a mushroom cloud.”

He then set the blaze that has continued to rage for nearly six years, consuming more than 4,000 American lives and hundreds of thousands of Iraqis. (A car bomb over the weekend killed two dozen more Iraqis, many of them religious pilgrims.) The financial cost to the U.S. will eventually reach $3 trillion or more, according to the Nobel laureate economist Joseph Stiglitz.

A year into the war Mr. Bush was cracking jokes about it at the annual dinner of the Radio and Television Correspondents Association. He displayed a series of photos that showed him searching the Oval Office, peering behind curtains and looking under the furniture. A mock caption had Mr. Bush saying: “Those weapons of mass destruction have got to be somewhere.”

And then there’s the Bush economy, another disaster, a trapdoor through which middle-class Americans can plunge toward the bracing experiences normally reserved for the poor and the destitute.

Mr. Bush traveled the country in the early days of his presidency, promoting his tax cut plans as hugely beneficial to small-business people and families of modest means. This was more deceit. The tax cuts would go overwhelmingly to the very rich.

The president would give the wealthy and the powerful virtually everything they wanted. He would throw sand into the regulatory apparatus and help foster the most extreme income disparities since the years leading up to the Great Depression. Once again he was lighting a fire. This time the flames would engulf the economy and, as with Iraq, bring catastrophe.

If the U.S. were a product line, it would be seen now as deeply damaged goods, subject to recall.

There seemed to be no end to Mr. Bush’s talent for destruction. He tried to hand the piggy bank known as Social Security over to the marauders of the financial sector, but saner heads prevailed.

In New Orleans, the president failed to intervene swiftly and decisively to aid the tens of thousands of poor people who were very publicly suffering and, in many cases, dying. He then compounded this colossal failure of leadership by traveling to New Orleans and promising, in a dramatic, floodlit appearance, to spare no effort in rebuilding the flood-torn region and the wrecked lives of the victims.

He went further, vowing to confront the issue of poverty in America “with bold action.”

It was all nonsense, of course. He did nothing of the kind.

The catalog of his transgressions against the nation’s interests — sins of commission and omission — would keep Mr. Bush in a confessional for the rest of his life. Don’t hold your breath. He’s hardly the contrite sort.

He told ABC’s Charlie Gibson: “I don’t spend a lot of time really worrying about short-term history. I guess I don’t worry about long-term history, either, since I’m not going to be around to read it.”

The president chuckled, thinking — as he did when he made his jokes about the missing weapons of mass destruction — that there was something funny going on.

http://www.nytimes.com/2008/12/30/opinion/30herbert.html?_r=1

Op-Ed Columnist

Add Up the Damage

comments (141)

new_york_times:http://www.nytimes.com/2008/12/30/opinion/30herbert.html

By BOB HERBERT

Published: December 29, 2008

Does anyone know where George W. Bush is?

Post a Comment »

Read All Comments (141) »

You don’t hear much from him anymore. The last image most of us remember is of the president ducking a pair of size 10s that were hurled at him in Baghdad.

We’re still at war in Iraq and Afghanistan. Israel is thrashing the Palestinians in Gaza. And the U.S. economy is about as vibrant as the 0-16 Detroit Lions.

But hardly a peep have we heard from George, the 43rd.

When Mr. Bush officially takes his leave in three weeks (in reality, he checked out long ago), most Americans will be content to sigh good riddance. I disagree. I don’t think he should be allowed to slip quietly out of town. There should be a great hue and cry — a loud, collective angry howl, demonstrations with signs and bullhorns and fiery speeches — over the damage he’s done to this country.

This is the man who gave us the war in Iraq and Guantánamo and torture and rendition; who turned the Clinton economy and the budget surplus into fool’s gold; who dithered while New Orleans drowned; who trampled our civil liberties at home and ruined our reputation abroad; who let Dick Cheney run hog wild and thought Brownie was doing a heckuva job.

The Bush administration specialized in deceit. How else could you get the public (and a feckless Congress) to go along with an invasion of Iraq as an absolutely essential response to the Sept. 11 attacks, when Iraq had had nothing to do with the Sept. 11 attacks?

Exploiting the public’s understandable fears, Mr. Bush made it sound as if Iraq was about to nuke us: “We cannot wait,” he said, “for the final proof — the smoking gun that could come in the form of a mushroom cloud.”

He then set the blaze that has continued to rage for nearly six years, consuming more than 4,000 American lives and hundreds of thousands of Iraqis. (A car bomb over the weekend killed two dozen more Iraqis, many of them religious pilgrims.) The financial cost to the U.S. will eventually reach $3 trillion or more, according to the Nobel laureate economist Joseph Stiglitz.

A year into the war Mr. Bush was cracking jokes about it at the annual dinner of the Radio and Television Correspondents Association. He displayed a series of photos that showed him searching the Oval Office, peering behind curtains and looking under the furniture. A mock caption had Mr. Bush saying: “Those weapons of mass destruction have got to be somewhere.”

And then there’s the Bush economy, another disaster, a trapdoor through which middle-class Americans can plunge toward the bracing experiences normally reserved for the poor and the destitute.

Mr. Bush traveled the country in the early days of his presidency, promoting his tax cut plans as hugely beneficial to small-business people and families of modest means. This was more deceit. The tax cuts would go overwhelmingly to the very rich.

The president would give the wealthy and the powerful virtually everything they wanted. He would throw sand into the regulatory apparatus and help foster the most extreme income disparities since the years leading up to the Great Depression. Once again he was lighting a fire. This time the flames would engulf the economy and, as with Iraq, bring catastrophe.

If the U.S. were a product line, it would be seen now as deeply damaged goods, subject to recall.

There seemed to be no end to Mr. Bush’s talent for destruction. He tried to hand the piggy bank known as Social Security over to the marauders of the financial sector, but saner heads prevailed.

In New Orleans, the president failed to intervene swiftly and decisively to aid the tens of thousands of poor people who were very publicly suffering and, in many cases, dying. He then compounded this colossal failure of leadership by traveling to New Orleans and promising, in a dramatic, floodlit appearance, to spare no effort in rebuilding the flood-torn region and the wrecked lives of the victims.

He went further, vowing to confront the issue of poverty in America “with bold action.”

It was all nonsense, of course. He did nothing of the kind.

The catalog of his transgressions against the nation’s interests — sins of commission and omission — would keep Mr. Bush in a confessional for the rest of his life. Don’t hold your breath. He’s hardly the contrite sort.

He told ABC’s Charlie Gibson: “I don’t spend a lot of time really worrying about short-term history. I guess I don’t worry about long-term history, either, since I’m not going to be around to read it.”

The president chuckled, thinking — as he did when he made his jokes about the missing weapons of mass destruction — that there was something funny going on.

Monday, December 29, 2008

Emphasis on Weatherization

Dry topic but relevant to this blog.

http://www.nytimes.com/2008/12/30/us/30weatherize.html?adxnnl=1&adxnnlx=1230602667-HY8SijqoRzAB1Nn3xRaFXg

http://www.nytimes.com/2008/12/30/us/30weatherize.html?adxnnl=1&adxnnlx=1230602667-HY8SijqoRzAB1Nn3xRaFXg

Michael Lewis's New Book "Panic" Favorably Reviewed

Readers of this blog will note that I refer to "Liar's Poker" more often than almost any other topic. That is because he called it the first and continues to call it.

What is "it?" Wall Street complex derivatives and their devastating effect on the economy.

His new book "Panic" is worth a read. Although I gave a copy to my son-in-law I have not yet read it.

http://www.nytimes.com/2008/12/28/books/review/Gross-t.html

What is "it?" Wall Street complex derivatives and their devastating effect on the economy.

His new book "Panic" is worth a read. Although I gave a copy to my son-in-law I have not yet read it.

http://www.nytimes.com/2008/12/28/books/review/Gross-t.html

50 Herbert Hoovers -- Krugman

State governments are cutting when they should not be.

http://www.nytimes.com/2008/12/29/opinion/29krugman.html

http://www.nytimes.com/2008/12/29/opinion/29krugman.html

Sunday, December 28, 2008

Madoff and The Cincinnati Stock Exchange

Northampton Mass mentioned again. Another wipeout. One was the reservior break in 1874 and the other was Madoff. 138 years apart.

http://news.cincinnati.com/article/20081228/BIZ/812280363/1055/NEWS

http://news.cincinnati.com/article/20081228/BIZ/812280363/1055/NEWS

Hoosier Baroque -- Morgenson

Right here in Indianapolis, and before my friend Judge David Hamilton.

http://www.nytimes.com/2008/12/21/business/21gret.html

http://www.nytimes.com/2008/12/21/business/21gret.html

Interesting Comments and History re Dreier and Madoff

Cross of Iron by John Mosier -- Indexed

I just finished this excellent, excellent book, which turns many of the myths of WWI and WWII on its head. (I will not say "on their heads.")

http://books.google.com/books?id=u4GGY8W9TB8C&pg=PT1&lpg=PT1&dq=mosier+WWII+cross+of+iron&source=bl&ots=1c14Krxd1E&sig=gcsHb9L1RjarBKR4BM9jURAYfvA&hl=en&sa=X&oi=book_result&resnum=1&ct=result#PPA176,M1

http://books.google.com/books?id=u4GGY8W9TB8C&pg=PT1&lpg=PT1&dq=mosier+WWII+cross+of+iron&source=bl&ots=1c14Krxd1E&sig=gcsHb9L1RjarBKR4BM9jURAYfvA&hl=en&sa=X&oi=book_result&resnum=1&ct=result#PPA176,M1

Record High in Cincinnati Yesterday

68 degrees. Lasted for about 7 hours into the late evening. Went to Open House at Mike and Laurie Burnhams.

Saturday, December 27, 2008

Morgenson and WaMu

Long so I have not reviewed it, but Morgenson is tops so it will be good.

http://www.nytimes.com/2008/12/28/business/28wamu.html?_r=1&hp

http://www.nytimes.com/2008/12/28/business/28wamu.html?_r=1&hp

Labels:

Countrywide,

Gretchen Morgenson,

Liar's Poker by Michael Lewis,

real estate,

washinton mutual

Stop Being Stupid -- Herbert

Oh what a littany of things we have been stupid about:

http://www.nytimes.com/2008/12/27/opinion/27herbert.html?hp

http://www.nytimes.com/2008/12/27/opinion/27herbert.html?hp

Friday, December 26, 2008

Tech Tips -- Prepaid Cell Phones

I haven't gotten into this very deeply, but it's a start.

http://biz.yahoo.com/conreps/081201/099.html?.&.pf=family-home

http://biz.yahoo.com/conreps/081201/099.html?.&.pf=family-home

Restore That Good Government Feel -- Krugman

Tech Tips

Gettingh tech help on the internet. I haven't seen the point of this article yet, but I feel it is there. Why not just Google your question generally?

http://www.nytimes.com/2008/12/25/technology/personaltech/25basics.html?_r=1&em

http://www.nytimes.com/2008/12/25/technology/personaltech/25basics.html?_r=1&em

Thursday, December 25, 2008

Wednesday, December 24, 2008

Flynn's Oil Exeter NH

$2.239

Charlie Rose Last Friday

My notes from looking at TIVO

7:27 AM 12/24/2008

notes on Charlie Rose 12/19/2008

Malcolm Gladwell

"Outliers"

The Story of Success

Also wrote The Tipping Point and Blink, both on nyt best seller list. Writes for New Yorker.

Fascinated by performance…and success

Own phenoneminal success…grandmother

Nature of the lucky break

Bill Gates

Walks into 8th gr at lakeside acad seattle; computer term linked into downtown computer; 1968

Basically spends entire teenage yrs programming

With paul allen – mainframe at univ of wash..2-6am. Free

Extraod desire + living 2 miles from a mainframe that’s avail 2-6 in the morning

Beatles

Same thing. Cog complex activities; 10 years; 10,000 hours; always

1st in a cohort to reach 10,000 hours

Tiger Woods

Very good circumstances

deliberate practice...focused, intensive, with an eye on your failures

Michael Jordan as a 16 year old...practices in a different way...what am I not doing well? Why am I not doing it well?

His game changes throughout his career.

not great outside shooter when he starts...added to his arsenal

Charlie summarizes:

access to deliberate practice...over 10,000 times

how to help people achieve their potential:

give them opp to work harder

extend school day, extend into summer

what separates kids who want to work hard?

Can’t work hard unless there’s a school to do it.

Jewish lawyers Bronx and brooklyn

'30s and '40s

end up top of legal prof in New York

because were forbidden to work at the downtown white shoe firms

practiced.....for many years in unfashionable area of corporate law called "takeovers."

later when the demand was there they were in the forefront

NYU

“sleights” are or can be of great importance ... Jordan doesn't make his team at age 9

Colvin says he did not have a sleight.

Talent does not exist…it’s all application.

Beatles went to Hamburg in the '50s...willing to play 8 hr sets a day, 7 days a week, in the nastiest of circumstances

Obama

second part of my book deals with "culture"

how diff cultures have diff strengths

asian kids are better at math tests...huge difference

we know it's not genetic

they work harder...why?

ans: patterns of ag practice; rice.

My father’s European ancest wheat fields of northern england; drunk in winter; worked only 1000 hrs a year

Chinese: 3000 hrs a year; infinitely more labor intensive than western ag

1500 years…doesn't go away

makes you good at math

no one has a better theory

what is your gift?

I'm a child of a mathematician and a therapist

father...highly specialized complex math

mother...communication with people at basic emotional level

(autism).

my writing shuttles back and forth between obscure and how to communicate to a mass audience

my mother is a beautiful translator and my writing role model...she's also a writer

“All good writing must have clarity.”

My mother: having extraordinary mother of her own

Daisy

Jamaican culture

Mom ends up upper middle class in Canada.

Her success…a function of …privileged brown-skinned Jamaican class. Not sent back into slavery as they were in the American South.

lifted out of slavery; Irish plantation owner takes as his concubine

(Daisy)

Colin Powell is my cousin and from the same privileged Jamaican class

Must know about Jamaican history and tangled class…

Charlie:

seeing that goal and wanting to get to that goal

Malcolm

Bill Joy

his time undergrad at Michigan

computer room

we writes the rules on the internet

I have a chapter on Jewish lawyers

parents off the boats...have a sense..my child will end up meaningful...propels kids

Hunter College..one of first gifted programs

kids are basically of genius level

what they end up doing...not that impressive...happy lives but nothing spectacular

kids were so smart that they understood what it would take to be good and decided not to do it!

Paradox of Genius

how completely unimportant is high IQ

our society is obsessed

need to be "smart enough"

iq matters up to 120

have coffee with Nathan Bilbow(?)

ask him any ques..."It is impossible that his answer will not be useful in some way."

He has this ability to construct this network of fascinating people

who gets curiosity and who doesn't?

meaningful work?

(1) autonomous (no one's looking over your shoulder)

(2) complex

(3) rela between work and reward

garment industry is all these things ie meaningful

explicitly enterpreunerial

rela between work and reward

Mexican workers picking fruit in California...not meaningful in any way

what if Jewish had gone to central valley in Calif and Mexicans had gone to New York?

if you are convinced that the thing you are doing is meaningful, then there's no "cost" to it.

most people do not have the time to organize their experiences...I (Gladwell) do

I work (write) in public...coffee houses, book stores. I'm a product of the wash post..newsroom...loud and noisy

in a quiet office i almost lost my mind

Geoff Colvin, author

"Talent is Overrated"

research...what is the source of top-level, world-class performance?

what does seem to be explan... a particular type of hard work

"deliberate practice"

starting young is very helpful...can accumulate more hours...parts of your brain will be affected

areas of your brain take over

can happen at any age; effect is greater when you're a kid

takes 10 years to get good at anything

doesn't matter what field

to get world class

Exh A

Tiger Woods

father put golf club in his hands at age of 7 mos

practiced at age of 2

professional teachers at age of 4

working hard for 17 yrs with proffesional teachers so in his late teens he's way ahead

focusing on something that is critically important

training has to be designed for this moment in your development

Tiger going to sand trap and drop ball so it's fully covered; practicing 200 times; not because he will encounter this a lot, but when he does he will have a feel for what to do.

Chapter 7

applying principles in our lives

practice...will give you finely-tuned instrument

got that way...weren't born that way

understanding your business is critical...some people think that all you need is management skills

you need deep knowledge of what you are doing

what about child prodigies?

mozart

remarkably parallel with story of tiger woods

1st world class work at age of 21

training under his father

refers to Malcolm Gladwell

circumstances

yes, the supporting environment

can be family

larger sense

what's gong on in the civilization around you

where you are born

7:27 AM 12/24/2008

notes on Charlie Rose 12/19/2008

Malcolm Gladwell

"Outliers"

The Story of Success

Also wrote The Tipping Point and Blink, both on nyt best seller list. Writes for New Yorker.

Fascinated by performance…and success

Own phenoneminal success…grandmother

Nature of the lucky break

Bill Gates

Walks into 8th gr at lakeside acad seattle; computer term linked into downtown computer; 1968

Basically spends entire teenage yrs programming

With paul allen – mainframe at univ of wash..2-6am. Free

Extraod desire + living 2 miles from a mainframe that’s avail 2-6 in the morning

Beatles

Same thing. Cog complex activities; 10 years; 10,000 hours; always

1st in a cohort to reach 10,000 hours

Tiger Woods

Very good circumstances

deliberate practice...focused, intensive, with an eye on your failures

Michael Jordan as a 16 year old...practices in a different way...what am I not doing well? Why am I not doing it well?

His game changes throughout his career.

not great outside shooter when he starts...added to his arsenal

Charlie summarizes:

access to deliberate practice...over 10,000 times

how to help people achieve their potential:

give them opp to work harder

extend school day, extend into summer

what separates kids who want to work hard?

Can’t work hard unless there’s a school to do it.

Jewish lawyers Bronx and brooklyn

'30s and '40s

end up top of legal prof in New York

because were forbidden to work at the downtown white shoe firms

practiced.....for many years in unfashionable area of corporate law called "takeovers."

later when the demand was there they were in the forefront

NYU

“sleights” are or can be of great importance ... Jordan doesn't make his team at age 9

Colvin says he did not have a sleight.

Talent does not exist…it’s all application.

Beatles went to Hamburg in the '50s...willing to play 8 hr sets a day, 7 days a week, in the nastiest of circumstances

Obama

second part of my book deals with "culture"

how diff cultures have diff strengths

asian kids are better at math tests...huge difference

we know it's not genetic

they work harder...why?

ans: patterns of ag practice; rice.

My father’s European ancest wheat fields of northern england; drunk in winter; worked only 1000 hrs a year

Chinese: 3000 hrs a year; infinitely more labor intensive than western ag

1500 years…doesn't go away

makes you good at math

no one has a better theory

what is your gift?

I'm a child of a mathematician and a therapist

father...highly specialized complex math

mother...communication with people at basic emotional level

(autism).

my writing shuttles back and forth between obscure and how to communicate to a mass audience

my mother is a beautiful translator and my writing role model...she's also a writer

“All good writing must have clarity.”

My mother: having extraordinary mother of her own

Daisy

Jamaican culture

Mom ends up upper middle class in Canada.

Her success…a function of …privileged brown-skinned Jamaican class. Not sent back into slavery as they were in the American South.

lifted out of slavery; Irish plantation owner takes as his concubine

(Daisy)

Colin Powell is my cousin and from the same privileged Jamaican class

Must know about Jamaican history and tangled class…

Charlie:

seeing that goal and wanting to get to that goal

Malcolm

Bill Joy

his time undergrad at Michigan

computer room

we writes the rules on the internet

I have a chapter on Jewish lawyers

parents off the boats...have a sense..my child will end up meaningful...propels kids

Hunter College..one of first gifted programs

kids are basically of genius level

what they end up doing...not that impressive...happy lives but nothing spectacular

kids were so smart that they understood what it would take to be good and decided not to do it!

Paradox of Genius

how completely unimportant is high IQ

our society is obsessed

need to be "smart enough"

iq matters up to 120

have coffee with Nathan Bilbow(?)

ask him any ques..."It is impossible that his answer will not be useful in some way."

He has this ability to construct this network of fascinating people

who gets curiosity and who doesn't?

meaningful work?

(1) autonomous (no one's looking over your shoulder)

(2) complex

(3) rela between work and reward

garment industry is all these things ie meaningful

explicitly enterpreunerial

rela between work and reward

Mexican workers picking fruit in California...not meaningful in any way

what if Jewish had gone to central valley in Calif and Mexicans had gone to New York?

if you are convinced that the thing you are doing is meaningful, then there's no "cost" to it.

most people do not have the time to organize their experiences...I (Gladwell) do

I work (write) in public...coffee houses, book stores. I'm a product of the wash post..newsroom...loud and noisy

in a quiet office i almost lost my mind

Geoff Colvin, author

"Talent is Overrated"

research...what is the source of top-level, world-class performance?

what does seem to be explan... a particular type of hard work

"deliberate practice"

starting young is very helpful...can accumulate more hours...parts of your brain will be affected

areas of your brain take over

can happen at any age; effect is greater when you're a kid

takes 10 years to get good at anything

doesn't matter what field

to get world class

Exh A

Tiger Woods

father put golf club in his hands at age of 7 mos

practiced at age of 2

professional teachers at age of 4

working hard for 17 yrs with proffesional teachers so in his late teens he's way ahead

focusing on something that is critically important

training has to be designed for this moment in your development

Tiger going to sand trap and drop ball so it's fully covered; practicing 200 times; not because he will encounter this a lot, but when he does he will have a feel for what to do.

Chapter 7

applying principles in our lives

practice...will give you finely-tuned instrument

got that way...weren't born that way

understanding your business is critical...some people think that all you need is management skills

you need deep knowledge of what you are doing

what about child prodigies?

mozart

remarkably parallel with story of tiger woods

1st world class work at age of 21

training under his father

refers to Malcolm Gladwell

circumstances

yes, the supporting environment

can be family

larger sense

what's gong on in the civilization around you

where you are born

Tuesday, December 23, 2008

IndyMac -- Why Not Backdate Life Itself?

The story about IndyMac is about backdating.

I’m going to backdate my life.

I did date Marilyn Monroe in high school.

I was born October 30, 1949, not 1939.

I did take Mergers & Acquisitions at Harvard Law School instead of Professor Vorenberg’s easier version.

I did tell John Egbert I would like to do labor law at Frost & Jacobs, and switch from the general litigation section under Jim Headley.

Dorchow -- Remember That Name

A key backdating allowed. So why was he kept on at the Office of Thrift Supervision, after he did the same type of thing in the savings and loan scandal?

http://www.nytimes.com/2008/12/23/business/23thrift.html?hp

http://www.nytimes.com/2008/12/23/business/23thrift.html?hp

Judith Warner Hits Home to Me

Hiring Window Open at Foreign Service

Well, let's get going. We've lost eight years and more, promoting the assinine theme of "deregulation."

http://www.nytimes.com/2008/12/21/jobs/21officers.html?em

http://www.nytimes.com/2008/12/21/jobs/21officers.html?em

City-Data Blog re Heating an Old Victorian House

Nerdy, about heating an old Victorian house in Cincinnati.

http://www.city-data.com/forum/cincinnati/518177-home-heating-duke-energy.html

Equally nerdy but very valuable:

www.dulley.com

http://www.city-data.com/forum/cincinnati/518177-home-heating-duke-energy.html

Equally nerdy but very valuable:

www.dulley.com

Labels:

city-data,

dulley,

Heating Degree Days,

natural gas,

victorian homes

Monday, December 22, 2008

Dealing With Disciplinary Counsel -- A Lawyer's Trust Account is Sacred; Madoff, Take Note

On the other hand the legal profession polices its own over the sacred "trust account."

August 22, 2008

Amy C. Stone

Assistant Disciplinary Counsel

Office of Disciplinary Counsel

Supreme Court of Ohio

250 Civic Center Drive, Suite 325

Columbus OH 43215-7411

Re: ODC File No. Ax-xxxx

Dear Ms. Stone:

This letter is in response to your letter of August 19, 2008. I will try to provide explanation of the overdraft with as much detail as possible.

My personal account at US Bank is ; my US Bank IOLTA trust account is .

I will always remember this check out of my IOLTA trust account: Check No. 2101 for $1594.79 made out to , my client.

I owed the client money back from a retainer and I was leaving on vacation in Canada July 22, 2008. I had misplaced my trust checkbook which got buried (I later found it 10 days ago) between stacks of discovery papers I was reviewing for a major upcoming piece of litigation. And had ordered and just received new checks from the bank. (This check is the first of the new checks.)

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Two

J and S called me for legal advice in April 2008. Their address is Zig Zag Road, Cincinnati OH 45242 and cell phone number is 513- . I agreed to write a strong letter in his behalf against a Mr. L over an expensive motorcycle dispute, and I was paid a one-time fee of $300 to write this letter. (Exhibits A, B) This amount was properly deposited in my personal account, . (Id.)

Later in April Mr. asked me to pursue the case in court and wrote me a check for $2950 as a deposit for court costs and legal work to be done. This amount was properly placed in my trust account, . (Exhibit C)

The offending check is Exhibit D Dated July 22, 2008.

Subsequently, perforce, I performed legal work and some of the trust money was appropriately drawn down for such and filing fees and postage, duly reported to the clients. (Exhibit E)

On July 8th our legal agreement terminated and I returned the remainder of my client’s deposit (Id.) before my wife and I left for the 18-day vacation. Although I carefully determined the amount I owed back to Mr. I, forgot that the first $300 had not gone into the trust account. (See Exhibit K for the running account to the clients); next I wrote the entire amount out of the Trust Account. Therefore when I withdrew the $1594.79 to pay Mr. I back, there was a deficit in the Trust Account, as $300 of it should have come from my personal account, and $1294.79 from the trust account.

The bank did honor this check (Exhibit D) in spite of the overdraw, so there was no damage done to the client, as your document shows. Immediately upon my return to Cincinnati, I found in the mail the bank notice, called the bank and paid the bank for the overdraft plus $1.00, out of account --, to keep the trust account going.

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Three

The bank waived any penalty upon seeing I had over $18,000 sitting there in my checking account. Enclosed you will find:

Exhibit A: bank statement of April 24, 2008, showing a $500 deposit into my personal checking account.

Exhibit B: my checkbook showing the breaking down of the original $500 deposit reflecting a payment from Mr. I of $300 and another client of $200

Exhibit C: IOLTA bank statement of April 30, 2008, showing deposit of $2950.00, dated April 28, 2008

Exhibit D: Copy of the subject $1594.79 check[1] to client from the trust account

Exhibit E: Copy of invoice for legal fees, certified mail and filing fees sent to client

Exhibit F: June 30, 2008, IOLTA statement, as required by your letter but not otherwise relevant

Exhibit G: July 31, 2008, IOLTA statement showing overdraft of $216.05

Exhibit H: August 21, 2008 partial month, personal account xxxx statement showing debit of $217.05 to cover the overdraft plus $1.00

Exhibit I: Bank Memo showing Transfer of $217.05 out of personal account but not showing the account to which it went

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Four

Exhibit J: August 21, 2008, Fax specifically showing transfer of that same amount into the IOLTA account ---, on August 11, 2008

Exhibit K: Client ledger for the subject months April through July 2008, as required by your letter

I trust this paper trail will satisfy your inquiry into the overdraft of my IOLTA account caused by Check No. 2101.

Respectfully yours,

F. Bruce Abel

FBA:eh

Enclosures

[1] In viewing this check I note for the first time that the new checks I had ordered in early July for the trust account do not have “IOLTA” on them, and I have corrected this error of the bank.

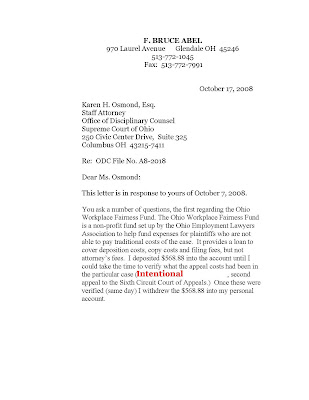

F. BRUCE ABEL

970 Laurel Avenue Glendale OH 45246

513-772-1045

Fax: 513-772-7991

September 30, 2008

Karen H. Osmond, Esq.

Staff Attorney

Office of Disciplinary Counsel

Supreme Court of Ohio

250 Civic Center Drive, Suite 325

Columbus OH 43215-7411

Re: ODC File No. A8-2018

Dear Ms. Osmond:

This letter is in response to yours of September 18, 2008. I will try to provide explanation of the overdraft with as much detail as possible. After review I agree with your conclusion that the “xxxxx” matter did not cause the overdraft. Rather, it was the “xxxxxxxx” matter.

In February 2008 Mr. xxxxx xxxxxxxx came to me in great need of an attorney. He had been accused of sexually harassing a bartender at xxxxxxxxx on the Levy (Newport). The attorney from Florida for xxxxxxxxx had represented both xxxxxxxxx and Mr. xxxxxxxx. Belatedly the lawyer realized he had waived Mr. xxxxxxxx’s rights not to arbitrate. xxxxx needed his own attorney for the arbitration that was fairly well along.

I required of Mr. xxxxxxxx a $2500 deposit, against which I would debit my time. This amount was deposited in my US Bank IOLTA trust account 1-xxxx-xxxx (Exhibit A). As I put in the time @ $150/hour, I transferred the following to my personal account at US Bank (xxx-xxx-x):

Karen H. Osmond, Esq.

September 30, 2008

Page Two

2/25/08 $450 Check # 2095 3 hours Exhibit A

3/05/08 $450 # 2096 3 hours Exhibit B

5/09/08 $450 # 2100 3 hours Exhibit D

Two debits were made to cash:

3/05/08 $300 Check # 2097 2 hours Exhibit B

4/22/08 $300 #2098 2 hours Exhibit C

On May 9, 2008, I negotiated an agreement with xxxxxxxxx whereby they would reimburse us for all Mr. xxxxxxxx’s legal fees and expenses. On that date I anticipatorily refunded to him $1,000 (Check # 2101). (As it turns out, this was $450 more than was in his account. As can be seen, I had drawn down $1950, not $1500, and therefore there was a $450 shortfall to the trust account, which I have repaid from my personal account (Exhibit H)).

In August I had also deposited into my IOLTA account the $216.05 overcharge plus $1.00 (Exhibit H), the $1.00 to keep the account open. Friday I deposited $22.50 from my personal account into the IOLTA account to pay for the Check Printing ($23.50) minus the $1.00 “keep-account-open” charge.

To date I have yet to be reimbursed by xxxxxxxxx and have expended about five hours trying to get paid by xxxxxxxxx.

Why I deposited $1 more back to IOLTA:

You have asked about the extra $1.00? The bank said this was necessary to keep the account open.

Karen H. Osmond, Esq.

September 30, 2008

Page Three

Supporting documentation of the reimbursement for the July 21, 2008, check printing charge.

As Exhibit G shows, the check printing charge was made to this account automatically by the bank. After reviewing Rule 1.15,

discussed infra, I realize this should not be a charge to the trust. As stated supra, I added $23.50 to the trust Friday, September 26th, from my personal account.

Confirmation that I have read Rule 1.15 of the Ohio Rules of Professional Conduct.

I hereby confirm that I have read Rule 1.15 of the Ohio Rules of Professional Conduct.

I trust that this answers all questions pending in this matter.

Very truly yours,

F. Bruce Abel

FBA:eh

Enclosures

Exhibit A – IOLTA statement thru 2/29/08

Exhibit B– IOLTA statement thru 3/31/08

Exhibit C– IOLTA statement thru 4/30/08

Exhibit D– IOLTA statement thru 5/31/08

Exhibit E– IOLTA statement thru 6/30/08

[no Exhibit F exists]

Exhibit G – IOLTA statement thru 7/31/08 (was labeled Exhibit G to my first letter as well)

Exhibit H– IOLTA statement thru 8/31/08

August 22, 2008

Amy C. Stone

Assistant Disciplinary Counsel

Office of Disciplinary Counsel

Supreme Court of Ohio

250 Civic Center Drive, Suite 325

Columbus OH 43215-7411

Re: ODC File No. Ax-xxxx

Dear Ms. Stone:

This letter is in response to your letter of August 19, 2008. I will try to provide explanation of the overdraft with as much detail as possible.

My personal account at US Bank is ; my US Bank IOLTA trust account is .

I will always remember this check out of my IOLTA trust account: Check No. 2101 for $1594.79 made out to , my client.

I owed the client money back from a retainer and I was leaving on vacation in Canada July 22, 2008. I had misplaced my trust checkbook which got buried (I later found it 10 days ago) between stacks of discovery papers I was reviewing for a major upcoming piece of litigation. And had ordered and just received new checks from the bank. (This check is the first of the new checks.)

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Two

J and S called me for legal advice in April 2008. Their address is Zig Zag Road, Cincinnati OH 45242 and cell phone number is 513- . I agreed to write a strong letter in his behalf against a Mr. L over an expensive motorcycle dispute, and I was paid a one-time fee of $300 to write this letter. (Exhibits A, B) This amount was properly deposited in my personal account, . (Id.)

Later in April Mr. asked me to pursue the case in court and wrote me a check for $2950 as a deposit for court costs and legal work to be done. This amount was properly placed in my trust account, . (Exhibit C)

The offending check is Exhibit D Dated July 22, 2008.

Subsequently, perforce, I performed legal work and some of the trust money was appropriately drawn down for such and filing fees and postage, duly reported to the clients. (Exhibit E)

On July 8th our legal agreement terminated and I returned the remainder of my client’s deposit (Id.) before my wife and I left for the 18-day vacation. Although I carefully determined the amount I owed back to Mr. I, forgot that the first $300 had not gone into the trust account. (See Exhibit K for the running account to the clients); next I wrote the entire amount out of the Trust Account. Therefore when I withdrew the $1594.79 to pay Mr. I back, there was a deficit in the Trust Account, as $300 of it should have come from my personal account, and $1294.79 from the trust account.

The bank did honor this check (Exhibit D) in spite of the overdraw, so there was no damage done to the client, as your document shows. Immediately upon my return to Cincinnati, I found in the mail the bank notice, called the bank and paid the bank for the overdraft plus $1.00, out of account --, to keep the trust account going.

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Three

The bank waived any penalty upon seeing I had over $18,000 sitting there in my checking account. Enclosed you will find:

Exhibit A: bank statement of April 24, 2008, showing a $500 deposit into my personal checking account.

Exhibit B: my checkbook showing the breaking down of the original $500 deposit reflecting a payment from Mr. I of $300 and another client of $200

Exhibit C: IOLTA bank statement of April 30, 2008, showing deposit of $2950.00, dated April 28, 2008

Exhibit D: Copy of the subject $1594.79 check[1] to client from the trust account

Exhibit E: Copy of invoice for legal fees, certified mail and filing fees sent to client

Exhibit F: June 30, 2008, IOLTA statement, as required by your letter but not otherwise relevant

Exhibit G: July 31, 2008, IOLTA statement showing overdraft of $216.05

Exhibit H: August 21, 2008 partial month, personal account xxxx statement showing debit of $217.05 to cover the overdraft plus $1.00

Exhibit I: Bank Memo showing Transfer of $217.05 out of personal account but not showing the account to which it went

Amy C. Stone

Assistant Disciplinary Counsel

August 22, 2008

Page Four

Exhibit J: August 21, 2008, Fax specifically showing transfer of that same amount into the IOLTA account ---, on August 11, 2008

Exhibit K: Client ledger for the subject months April through July 2008, as required by your letter

I trust this paper trail will satisfy your inquiry into the overdraft of my IOLTA account caused by Check No. 2101.

Respectfully yours,

F. Bruce Abel

FBA:eh

Enclosures

[1] In viewing this check I note for the first time that the new checks I had ordered in early July for the trust account do not have “IOLTA” on them, and I have corrected this error of the bank.

F. BRUCE ABEL

970 Laurel Avenue Glendale OH 45246

513-772-1045

Fax: 513-772-7991

September 30, 2008

Karen H. Osmond, Esq.

Staff Attorney

Office of Disciplinary Counsel

Supreme Court of Ohio

250 Civic Center Drive, Suite 325

Columbus OH 43215-7411

Re: ODC File No. A8-2018

Dear Ms. Osmond:

This letter is in response to yours of September 18, 2008. I will try to provide explanation of the overdraft with as much detail as possible. After review I agree with your conclusion that the “xxxxx” matter did not cause the overdraft. Rather, it was the “xxxxxxxx” matter.

In February 2008 Mr. xxxxx xxxxxxxx came to me in great need of an attorney. He had been accused of sexually harassing a bartender at xxxxxxxxx on the Levy (Newport). The attorney from Florida for xxxxxxxxx had represented both xxxxxxxxx and Mr. xxxxxxxx. Belatedly the lawyer realized he had waived Mr. xxxxxxxx’s rights not to arbitrate. xxxxx needed his own attorney for the arbitration that was fairly well along.

I required of Mr. xxxxxxxx a $2500 deposit, against which I would debit my time. This amount was deposited in my US Bank IOLTA trust account 1-xxxx-xxxx (Exhibit A). As I put in the time @ $150/hour, I transferred the following to my personal account at US Bank (xxx-xxx-x):

Karen H. Osmond, Esq.

September 30, 2008

Page Two

2/25/08 $450 Check # 2095 3 hours Exhibit A

3/05/08 $450 # 2096 3 hours Exhibit B

5/09/08 $450 # 2100 3 hours Exhibit D

Two debits were made to cash:

3/05/08 $300 Check # 2097 2 hours Exhibit B

4/22/08 $300 #2098 2 hours Exhibit C

On May 9, 2008, I negotiated an agreement with xxxxxxxxx whereby they would reimburse us for all Mr. xxxxxxxx’s legal fees and expenses. On that date I anticipatorily refunded to him $1,000 (Check # 2101). (As it turns out, this was $450 more than was in his account. As can be seen, I had drawn down $1950, not $1500, and therefore there was a $450 shortfall to the trust account, which I have repaid from my personal account (Exhibit H)).

In August I had also deposited into my IOLTA account the $216.05 overcharge plus $1.00 (Exhibit H), the $1.00 to keep the account open. Friday I deposited $22.50 from my personal account into the IOLTA account to pay for the Check Printing ($23.50) minus the $1.00 “keep-account-open” charge.

To date I have yet to be reimbursed by xxxxxxxxx and have expended about five hours trying to get paid by xxxxxxxxx.

Why I deposited $1 more back to IOLTA:

You have asked about the extra $1.00? The bank said this was necessary to keep the account open.

Karen H. Osmond, Esq.

September 30, 2008

Page Three

Supporting documentation of the reimbursement for the July 21, 2008, check printing charge.

As Exhibit G shows, the check printing charge was made to this account automatically by the bank. After reviewing Rule 1.15,

discussed infra, I realize this should not be a charge to the trust. As stated supra, I added $23.50 to the trust Friday, September 26th, from my personal account.

Confirmation that I have read Rule 1.15 of the Ohio Rules of Professional Conduct.

I hereby confirm that I have read Rule 1.15 of the Ohio Rules of Professional Conduct.

I trust that this answers all questions pending in this matter.

Very truly yours,

F. Bruce Abel

FBA:eh

Enclosures

Exhibit A – IOLTA statement thru 2/29/08

Exhibit B– IOLTA statement thru 3/31/08

Exhibit C– IOLTA statement thru 4/30/08

Exhibit D– IOLTA statement thru 5/31/08

Exhibit E– IOLTA statement thru 6/30/08

[no Exhibit F exists]

Exhibit G – IOLTA statement thru 7/31/08 (was labeled Exhibit G to my first letter as well)

Exhibit H– IOLTA statement thru 8/31/08

Sunday, December 21, 2008

Business Week Readers' Comments on Madoff

Some minor gems contained therein:

http://www.businessweek.com/investing/insights/blog/archives/2008/12/madoff_meets_le.html?chan=top+news_top+news+index+-+temp_news+%2B+analysis

http://www.businessweek.com/investing/insights/blog/archives/2008/12/madoff_meets_le.html?chan=top+news_top+news+index+-+temp_news+%2B+analysis

Best Saturday Night Opening Monologue

Transcribed Tuesday, August 14, 2007

Opening Monologue:

Introductions

My name is Hugh Laurie

I would genuinely love to know all your names

But that’s not really a good use of our time, now, is it?

So instead if you don’t mind I’m just going to call you collectively… “Sweet Cheeks”

If you know me at all…the curmudgeonly misanthrope

“House” from the TV show of that name.

…But in real life I am…

I am daffodils

I am the morning dew

I am the laughter of children

I’m the smell of freshly baked bread

I am the postman’s cheery good morning

I am the yelp of the puppy freed from the microwave

I’m chicken-fed corn

The seven of clubs that fills the inside straight

I’m the grateful twinkle in your grandmother’s eyes as you reverse the tractor off her legs

I am sugar, spice and all things nice

I am the click on the empty chamber when it’s your turn in Russian Roulette

I am Hope, Love, Mankind, the World…I am everything….It’s called Lithium

Opening Monologue:

Introductions

My name is Hugh Laurie

I would genuinely love to know all your names

But that’s not really a good use of our time, now, is it?

So instead if you don’t mind I’m just going to call you collectively… “Sweet Cheeks”

If you know me at all…the curmudgeonly misanthrope

“House” from the TV show of that name.

…But in real life I am…

I am daffodils

I am the morning dew

I am the laughter of children

I’m the smell of freshly baked bread

I am the postman’s cheery good morning

I am the yelp of the puppy freed from the microwave

I’m chicken-fed corn

The seven of clubs that fills the inside straight

I’m the grateful twinkle in your grandmother’s eyes as you reverse the tractor off her legs

I am sugar, spice and all things nice

I am the click on the empty chamber when it’s your turn in Russian Roulette

I am Hope, Love, Mankind, the World…I am everything….It’s called Lithium

Energy Conversion Factors

No, I do not understand why this schedule is presented this way. Maybe he has a client in each category at the top across. Studebaker is a consultant who used to be an energy manager at one of the companies in KIUC, Kentucky Industrial Utilities Consortium.

Could James Simons be the Next Bernie Madoff?

By a form of front-running that may or may not be legal?

http://www.bloggingstocks.com/2008/12/21/could-james-simons-be-the-next-bernie-madoff/

http://www.bloggingstocks.com/2008/12/21/could-james-simons-be-the-next-bernie-madoff/

More Comments on Herbert -- Madoff

I especially like Comment #7.

http://community.nytimes.com/article/comments/2008/12/21/opinion/21rich.html

http://community.nytimes.com/article/comments/2008/12/21/opinion/21rich.html

Saturday, December 20, 2008

Tour de Force on Madoff in NYT Today

Well-written, but does it add much? Not sure.

http://www.nytimes.com/2008/12/20/business/20madoff.html?hp

http://www.nytimes.com/2008/12/20/business/20madoff.html?hp

Friday, December 19, 2008

Marko....Polus, Marko....Polus...Where Are You!

No, it's not summer at the pool. It's Markopolus, hiding. He's the hidden hero of Wall Street now.

http://biz.yahoo.com/ap/081219/madoff_scandal_whistleblower.html

http://biz.yahoo.com/ap/081219/madoff_scandal_whistleblower.html

And Krugman Writes it Best -- Madoff

This puts Madoff into the broader context of Wall Street and our Civil Society, i.e. the magnet of Wall Street and the utter waste of brains and money over the years:

http://www.nytimes.com/2008/12/19/opinion/19krugman.html?hp

The Madoff Economy

comments

new_york_times:http://www.nytimes.com/2008/12/19/opinion/19krugman.html

if (acm.cc) acm.cc.write();

By PAUL KRUGMAN

Published: December 19, 2008

The revelation that Bernard Madoff — brilliant investor (or so almost everyone thought), philanthropist, pillar of the community — was a phony has shocked the world, and understandably so. The scale of his alleged $50 billion Ponzi scheme is hard to comprehend.

Skip to next paragraph

Times Topics: Bernard L. Madoff

Post a Comment »

Yet surely I’m not the only person to ask the obvious question: How different, really, is Mr. Madoff’s tale from the story of the investment industry as a whole?

The financial services industry has claimed an ever-growing share of the nation’s income over the past generation, making the people who run the industry incredibly rich. Yet, at this point, it looks as if much of the industry has been destroying value, not creating it. And it’s not just a matter of money: the vast riches achieved by those who managed other people’s money have had a corrupting effect on our society as a whole.

Let’s start with those paychecks. Last year, the average salary of employees in “securities, commodity contracts, and investments” was more than four times the average salary in the rest of the economy. Earning a million dollars was nothing special, and even incomes of $20 million or more were fairly common. The incomes of the richest Americans have exploded over the past generation, even as wages of ordinary workers have stagnated; high pay on Wall Street was a major cause of that divergence.

But surely those financial superstars must have been earning their millions, right? No, not necessarily. The pay system on Wall Street lavishly rewards the appearance of profit, even if that appearance later turns out to have been an illusion.

Consider the hypothetical example of a money manager who leverages up his clients’ money with lots of debt, then invests the bulked-up total in high-yielding but risky assets, such as dubious mortgage-backed securities. For a while — say, as long as a housing bubble continues to inflate — he (it’s almost always a he) will make big profits and receive big bonuses. Then, when the bubble bursts and his investments turn into toxic waste, his investors will lose big — but he’ll keep those bonuses.

O.K., maybe my example wasn’t hypothetical after all.

So, how different is what Wall Street in general did from the Madoff affair? Well, Mr. Madoff allegedly skipped a few steps, simply stealing his clients’ money rather than collecting big fees while exposing investors to risks they didn’t understand. And while Mr. Madoff was apparently a self-conscious fraud, many people on Wall Street believed their own hype. Still, the end result was the same (except for the house arrest): the money managers got rich; the investors saw their money disappear.

We’re talking about a lot of money here. In recent years the finance sector accounted for 8 percent of America’s G.D.P., up from less than 5 percent a generation earlier. If that extra 3 percent was money for nothing — and it probably was — we’re talking about $400 billion a year in waste, fraud and abuse.

But the costs of America’s Ponzi era surely went beyond the direct waste of dollars and cents.

At the crudest level, Wall Street’s ill-gotten gains corrupted and continue to corrupt politics, in a nicely bipartisan way. From Bush administration officials like Christopher Cox, chairman of the Securities and Exchange Commission, who looked the other way as evidence of financial fraud mounted, to Democrats who still haven’t closed the outrageous tax loophole that benefits executives at hedge funds and private equity firms (hello, Senator Schumer), politicians have walked when money talked.

Meanwhile, how much has our nation’s future been damaged by the magnetic pull of quick personal wealth, which for years has drawn many of our best and brightest young people into investment banking, at the expense of science, public service and just about everything else?

Most of all, the vast riches being earned — or maybe that should be “earned” — in our bloated financial industry undermined our sense of reality and degraded our judgment.

Think of the way almost everyone important missed the warning signs of an impending crisis. How was that possible? How, for example, could Alan Greenspan have declared, just a few years ago, that “the financial system as a whole has become more resilient” — thanks to derivatives, no less? The answer, I believe, is that there’s an innate tendency on the part of even the elite to idolize men who are making a lot of money, and assume that they know what they’re doing.

After all, that’s why so many people trusted Mr. Madoff.

Now, as we survey the wreckage and try to understand how things can have gone so wrong, so fast, the answer is actually quite simple: What we’re looking at now are the consequences of a world gone Madoff.

More Articles in Opinion » A version of this article appeared in print on December 19, 2008, on page A45 of the New York edition.

http://www.nytimes.com/2008/12/19/opinion/19krugman.html?hp

The Madoff Economy

comments

new_york_times:http://www.nytimes.com/2008/12/19/opinion/19krugman.html

if (acm.cc) acm.cc.write();

By PAUL KRUGMAN

Published: December 19, 2008

The revelation that Bernard Madoff — brilliant investor (or so almost everyone thought), philanthropist, pillar of the community — was a phony has shocked the world, and understandably so. The scale of his alleged $50 billion Ponzi scheme is hard to comprehend.

Skip to next paragraph

Times Topics: Bernard L. Madoff

Post a Comment »

Yet surely I’m not the only person to ask the obvious question: How different, really, is Mr. Madoff’s tale from the story of the investment industry as a whole?

The financial services industry has claimed an ever-growing share of the nation’s income over the past generation, making the people who run the industry incredibly rich. Yet, at this point, it looks as if much of the industry has been destroying value, not creating it. And it’s not just a matter of money: the vast riches achieved by those who managed other people’s money have had a corrupting effect on our society as a whole.

Let’s start with those paychecks. Last year, the average salary of employees in “securities, commodity contracts, and investments” was more than four times the average salary in the rest of the economy. Earning a million dollars was nothing special, and even incomes of $20 million or more were fairly common. The incomes of the richest Americans have exploded over the past generation, even as wages of ordinary workers have stagnated; high pay on Wall Street was a major cause of that divergence.

But surely those financial superstars must have been earning their millions, right? No, not necessarily. The pay system on Wall Street lavishly rewards the appearance of profit, even if that appearance later turns out to have been an illusion.

Consider the hypothetical example of a money manager who leverages up his clients’ money with lots of debt, then invests the bulked-up total in high-yielding but risky assets, such as dubious mortgage-backed securities. For a while — say, as long as a housing bubble continues to inflate — he (it’s almost always a he) will make big profits and receive big bonuses. Then, when the bubble bursts and his investments turn into toxic waste, his investors will lose big — but he’ll keep those bonuses.

O.K., maybe my example wasn’t hypothetical after all.

So, how different is what Wall Street in general did from the Madoff affair? Well, Mr. Madoff allegedly skipped a few steps, simply stealing his clients’ money rather than collecting big fees while exposing investors to risks they didn’t understand. And while Mr. Madoff was apparently a self-conscious fraud, many people on Wall Street believed their own hype. Still, the end result was the same (except for the house arrest): the money managers got rich; the investors saw their money disappear.

We’re talking about a lot of money here. In recent years the finance sector accounted for 8 percent of America’s G.D.P., up from less than 5 percent a generation earlier. If that extra 3 percent was money for nothing — and it probably was — we’re talking about $400 billion a year in waste, fraud and abuse.

But the costs of America’s Ponzi era surely went beyond the direct waste of dollars and cents.

At the crudest level, Wall Street’s ill-gotten gains corrupted and continue to corrupt politics, in a nicely bipartisan way. From Bush administration officials like Christopher Cox, chairman of the Securities and Exchange Commission, who looked the other way as evidence of financial fraud mounted, to Democrats who still haven’t closed the outrageous tax loophole that benefits executives at hedge funds and private equity firms (hello, Senator Schumer), politicians have walked when money talked.

Meanwhile, how much has our nation’s future been damaged by the magnetic pull of quick personal wealth, which for years has drawn many of our best and brightest young people into investment banking, at the expense of science, public service and just about everything else?

Most of all, the vast riches being earned — or maybe that should be “earned” — in our bloated financial industry undermined our sense of reality and degraded our judgment.

Think of the way almost everyone important missed the warning signs of an impending crisis. How was that possible? How, for example, could Alan Greenspan have declared, just a few years ago, that “the financial system as a whole has become more resilient” — thanks to derivatives, no less? The answer, I believe, is that there’s an innate tendency on the part of even the elite to idolize men who are making a lot of money, and assume that they know what they’re doing.

After all, that’s why so many people trusted Mr. Madoff.

Now, as we survey the wreckage and try to understand how things can have gone so wrong, so fast, the answer is actually quite simple: What we’re looking at now are the consequences of a world gone Madoff.

More Articles in Opinion » A version of this article appeared in print on December 19, 2008, on page A45 of the New York edition.

The Clawbacks From Hell -- Madoff

In today's New York Times:

http://www.nytimes.com/2008/12/19/business/19ponzi.html?em

and Spitzer's family too was swindled by Madoff:

http://www.nytimes.com/2008/12/19/business/19spitzer.html?_r=1&partner=rss&emc=rss

http://www.nytimes.com/2008/12/19/business/19ponzi.html?em

and Spitzer's family too was swindled by Madoff:

http://www.nytimes.com/2008/12/19/business/19spitzer.html?_r=1&partner=rss&emc=rss

Thursday, December 18, 2008

Eat a Toad Every Morning -- Not Just You Madoff

Why do people want to invest all their money with Madoff?

http://finance.yahoo.com/expert/article/moneyhappy/129866

http://finance.yahoo.com/expert/article/moneyhappy/129866

SEC Case Closing Recommendation re Madoff (Two Years Later)

This closed the Markopolos charges against Markoff. Do you notice that "Markopolos," "Markoff" and "Masters of the Universe" all begin with "M?"

Markopolos as a name is suspect, I think. Could this whole thing be a sham to present to the world a scenerio where it looks like the rich got stung but not the rest of us?

http://online.wsj.com/public/resources/documents/Madoff_SECRecommend_20081217.pdf

Markopolos as a name is suspect, I think. Could this whole thing be a sham to present to the world a scenerio where it looks like the rich got stung but not the rest of us?

http://online.wsj.com/public/resources/documents/Madoff_SECRecommend_20081217.pdf

This Guy and the Boston SEC Had it Right on Madoff

Harry Markopolos was the whistleblower. Name is weird if not suspect, but his materials were brilliant.

Pretty good. Shows the turf war aspect of the case, between the Boston and New York offices of the SEC.

This link only gets you the first few paragraphs, but I had the whole article and will cut and paste it later.

http://online.wsj.com/article/SB122956182184616625.html?mod=special_page_campaign2008_mostpop

Brilliant. Stop everything and read this!

http://online.wsj.com/documents/Madoff_SECdocs_20081217.pdf

Pretty good. Shows the turf war aspect of the case, between the Boston and New York offices of the SEC.

This link only gets you the first few paragraphs, but I had the whole article and will cut and paste it later.

http://online.wsj.com/article/SB122956182184616625.html?mod=special_page_campaign2008_mostpop

Brilliant. Stop everything and read this!

http://online.wsj.com/documents/Madoff_SECdocs_20081217.pdf

Madoff: Culture and Effect of Real Estate

Handshake deals are the norm in New York real estate. So that culture is devastated.

http://www.nytimes.com/2008/12/18/business/18brokers.html?_r=1&hp

http://www.nytimes.com/2008/12/18/business/18brokers.html?_r=1&hp

Wednesday, December 17, 2008

Gasparino -- How the SEC Literally Got in Bed With Madoff

Herein thedailybeast:

http://www.thedailybeast.com/blogs-and-stories/2008-12-16/how-the-sec-got-in-bed-with-the-madoffs-literally/1/

http://www.thedailybeast.com/blogs-and-stories/2008-12-16/how-the-sec-got-in-bed-with-the-madoffs-literally/1/

Investigates Madoff, Then Marry His Daughter

The SEC investigated Madoff and fell in love. Who among us wouldn't have been seduced.

http://www.nytimes.com/2008/12/17/business/17madoff.html

http://www.nytimes.com/2008/12/17/business/17madoff.html

Cramer Creates the World

We are all looking -- at least I am -- for someone to describe the stock market so that we can believe again. Cramer tried it yesterday. I hope he's right. Depression -- now off the table because of the stunning .75 drop in interest rates by Bernanke and the fed. Mortgage interest rates of possibly 3 1/2 % for 30 years. Everybody out now to buy up real estate and mortgages.

Turn-around in real estate: before yesterday he was saying, wishfully? June 30, 2009. Now earlier, like NOW.

Verbatim from last night:

http://www.madmoneyrecap.com/madmoney_nightlyrecap_121608_1.htm

Turn-around in real estate: before yesterday he was saying, wishfully? June 30, 2009. Now earlier, like NOW.

Verbatim from last night:

http://www.madmoneyrecap.com/madmoney_nightlyrecap_121608_1.htm

Walter Noel and the Madoff Connection

What a wonderful guy Walter Noel is, and his family too! My late partner Charles H. Tobias, Jr. had his sophistication, wealth, calmness and charm, but Charles was honest. Charles died a year ago, after spending 14 years (after our firm broke up) with the Sixth Circuit Court of Appeals as a special magistrate settling cases. He had submitted his name to be a Sixth Circuit judge when Clinton was president, but another wonderful man, Jones (forget first name, Nathan maybe), got the appointment.

http://www.nytimes.com/2008/12/17/business/17hedge.html?_r=1&hp

http://www.nytimes.com/2008/12/17/business/17hedge.html?_r=1&hp

Tuesday, December 16, 2008

More Good Comments on Madoff Situation

Search All NYTimes.com

Tuesday, December 16, 2008

readers' comments

The 17th Floor, Where Wealth Went to VanishBack to Article »

Bernard L. Madoff’s offices in Midtown Manhattan are now an occupied zone, as investigators piece together an alleged Ponzi scheme worth billions of dollars.

RSSAll Comments - Editors' Selections

NYTimes.com editors aim to highlight the most interesting and thoughtful comments that represent a range of views.

1 - 13 of 13Show:

Oldest First Newest First Readers' Recommendations Editors' Selections Replies

9.

December 15, 2008 9:09 am

Link

Hmmmm, it seems the market is like the tide. When the water recedes it often exposes things sticking out of the mud that you never imagined were there.

— jackm, Boston

Recommend Recommended by 197 Readers

20.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 9:09 am

Link

If Madoff's family did not know of his scheme, imagine the deep betrayal they feel. His life was a lie, motivated by extreme greed and lust for power. Madoff is a man with absolutely no conscience, empathy, or self respect. Obviously the man is intelligent to be able to construct his elaborate network of deception. It is deeply sad that he has not used his intelligence to a positve cause.

— Carol, Cary, NC

Recommend Recommended by 50 Readers

27.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 9:21 am

Link

Who puts all of their life savings in one investment strategy? Even a small time investor like me knows not to do this!I feel badly for those who lost everything, but the reason you put all of your eggs in one basket was because of the spectacular returns he was getting you.This is called greed.

— Mary, Md.

Recommend Recommended by 106 Readers

28.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 9:41 am

Link

"And the 17th floor is now an occupied zone, as investigators and forensic auditors try to piece together what Mr. Madoff did with the billions..."PLEASE....send the investigators and forensic auditors to Paulson's office...

— Jackie, RI, USA

Recommend Recommended by 104 Readers

48.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 10:03 am

Link

This situation hits close to home. Earlier this year a relative of mine was convicted for running a similar scheme, albeit with real estate investments. The scope of that crime was in the tens of millions. I was burned along with hundreds of others.Knowing the perpetrator in that case as I do, and having seen that situation develop, my feeling is that there are no easy answers when a massive fraud takes place.One reason for the fraud is ego. Successful people often have a hard time admitting failure, and they have outsize expectations about their ability to fix problems. And they may also believe that their success entitles them to act above the law when it suits them.The investors, in the end, are credulous. They want to believe that the impossibly good returns they're getting are real. They want to trust the guy that they've known for years. And they want to think they're smart enough to never be fooled. (I include myself in this category.)And then there's a whole network of accountants, lawyers and bankers who turn a blind eye to what's actually happening. These professionals follow a culture of secrecy and denial. This culture may serve the interests of their clients, but it also makes it easy for them to wriggle out of responsibility when it suits them.I learned quite a bit about the investment business this year. I asked my attorney recently, what's the difference between a Ponzi scheme and an honest hedge fund?There really isn't one. In both, financial managers are given free rein to move money as they see fit to live up to their promises to investors. The SEC and, in most cases, state regulators don't have much oversight over hedge funds' operations. It's a dangerous situation, because it makes investors complacent about secrecy and a lack of oversight.I have become convinced that money corrupts, always and inexorably. To combat that, we need checks and balances. We need a government who will enforce existing securities laws before the fact. We need lawyers, accountants and bankers who care about right and wrong. And we need educated, non-complacent investors who will ask tough questions.

— Ben, Massachusetts

Recommend Recommended by 189 Readers

55.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 10:08 am

Link

There is no possibility that one man did all this himself. The volume of paperwork is simply too great for one person to handle. There were lots of others who knew, or in the reasonable exercise of their mental capacities, should have known that there was a crime going on here. Those people must be caught and prosecuted or there will be no justice, because it is a certainty that all of the money is long gone.It is also true that there were many people in the business who kept pointing out that Matoff's methods didn't make any sense; they weren't listened to. To understand the phenomenon look at "The Emperor's New Clothes," by the Brothers Grimm. There was also fear on the part of the financial press and investigators that they would be sued by a man with $50 billion in assets. What was the SEC afraid of? Where were they in all this?

— Joel L. Friedlander, Plainview, New York

Recommend Recommended by 92 Readers

69.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 10:37 am

Link

One side effect tragedy not discussed here is how many of the people duped by Madoff were major contributors to philanthropy. Here in Boston, the Carl and Ruth Shapiro Fund has lost millions and millions which they generously gave to local institutions. What a jerk this Madoff is.

— BeverlyCY, Boston

Recommend Recommended by 27 Readers

70.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 11:42 am

Link

People are posting comments about jail and being broke. Nothing will happen to him.He's already back at home and he's facing at most, something along the lines of a $1 million fine, which is a joke, seeing how fast he came up with his $10 million bail, and some prison time. This will be served at the end of a long trial and it will also be at a country club, compared to a real prison.

— PJC, New York, N.Y.

Recommend Recommended by 42 Readers

95.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 11:45 am

Link

"Hmmm ... so now the wealthy from Country Clubs are going to ride the bus alongside me? I wonder what their cologne preferences will be.""Good to see some rich people suffer."The so-called "wealthy from Country Clubs" worked hard to procure their wealth and a lot of ordinary citizens also lost their savings to this con man. But from the remarks like the ones I've quoted above, you'd think that having an above-average income would be tantamount to being evil. What about the people who bought houses knowing very well that they wouldn't be able to pay their monthly mortgages? Are they greedy for wanting a home? I am baffled by the very lack of sympathy for those who lost everything. Clearly, the only person who should be blamed in this case is Madoff himself.

— L.Y., New York, NY

Recommend Recommended by 26 Readers

143.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 11:56 am

Link

As a professional in a small non-profit that receives many of its donations from people whose money was invested with Madoff, I am heartbroken.

— ellie, washington, dc

Recommend Recommended by 24 Readers

236.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 1:54 pm

Link

I have seen a couple of uninformed comparisons of Social Security to a Ponzi scheme. If you don't know the difference, than you have a very poor understanding of the concept of intergenerational solidarity. While it is true that Social Security if it is too be self-sustaining requires ever larger inputs, it is also true that generous socially conscious nations can choose to reallocate resources to social security when in fact the inputs from current workers are inadequate. And the fundamental, basic difference, for those of you who don't get it, is that Ponzi schemes are about stealing from people, whereas Social Security schemes are about allowing people to age with dignity. There's a world of difference there, and glib false comparisions between Social Security and Ponzi schemes say more about the commentator's lack of committment to the fabric of our social contract as a nation than to any false analogies between generosity and fraud.

— Andrew, South America

Recommend Recommended by 44 Readers

305.

EDITORS' SELECTIONS (what's this?)

December 15, 2008 4:26 pm

Link