Pages

▼

Tuesday, June 28, 2011

Monday, June 27, 2011

Derivatives Cloud the Greece Analysis

So the one question I would ask CNBC, etc.: "Why do credit default swaps even exist now????"

http://www.nytimes.com/2011/06/23/business/global/23swaps.html?scp=1&sq=derivatives%20cloud&st=cse

http://www.nytimes.com/2011/06/23/business/global/23swaps.html?scp=1&sq=derivatives%20cloud&st=cse

Saturday, June 25, 2011

Sunday, June 19, 2011

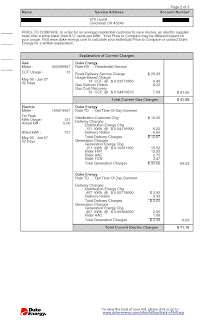

Smart Metering and Poles

Sometime during the week a subcontractor for Duke Energy knocked on the door wanting to clear brush from a pole so that they could put up a piece of electrical equipment that would enable Duke to read my time-of-day meter wirelessly.

Jimmy Rogers Interviewed by Dylan Ratigan!

http://jimrogers-investments.blogspot.com/2011/06/video-greece-is-bankrupt-protect.html

[from Wikipedia] Rogers was born in Baltimore, Maryland and raised in Demopolis, Alabama.[1][3] He started in business at the age of five by selling peanuts and by picking up empty bottles that fans left behind at baseball games. He got his first job on Wall Street, at Dominick & Dominick, after graduating with a bachelor's degree from Yale University in 1964. Rogers then acquired a second BA degree in Philosophy, Politics and Economics from Balliol College, Oxford University in 1966.

In 1970, Rogers joined Arnhold and S. Bleichroder. In 1973, Rogers co-founded the Quantum Fund with George Soros. During the following 10 years, the portfolio gained 4200% while the S&P advanced about 47%.[4] The Quantum Fund was one of the first truly international funds.

[from Wikipedia] Rogers was born in Baltimore, Maryland and raised in Demopolis, Alabama.[1][3] He started in business at the age of five by selling peanuts and by picking up empty bottles that fans left behind at baseball games. He got his first job on Wall Street, at Dominick & Dominick, after graduating with a bachelor's degree from Yale University in 1964. Rogers then acquired a second BA degree in Philosophy, Politics and Economics from Balliol College, Oxford University in 1966.

In 1970, Rogers joined Arnhold and S. Bleichroder. In 1973, Rogers co-founded the Quantum Fund with George Soros. During the following 10 years, the portfolio gained 4200% while the S&P advanced about 47%.[4] The Quantum Fund was one of the first truly international funds.